For the 24 hours to 23:00 GMT, the USD strengthened 1.07% against the JPY and closed at 118.16.

Yesterday, the BoJ held its interest rate unchanged at 0.1% and kept its monetary policy steady. Also, the central bank kept its economic view unchanged despite a disappointing GDP data reported recently.

In other economic news, Japan’s leading economic index rose to a level of 105.6 in September, following a similar reading registered in the prior month.

In the Asian session, at GMT0400, the pair is trading at 118.35, with the USD trading 0.17% higher from yesterday’s close.

Earlier today, data from Japan showed that the nation’s exports rose 9.6% on an annual basis in October, registering its highest level in 8-months, beating market expectations for a 4.5% gain.

In other economic data, Japan’ flash manufacturing PMI unexpectedly eased to 52.1 in November, lower than market expectations of an advance to a level of 52.7. In the prior month, manufacturing PMI had recorded a level of 52.40. Meanwhile, the nation’s adjusted merchandise trade deficit unexpectedly contracted to ¥977.5 billion in October, while markets were expecting it to widen to ¥1100.0 billion

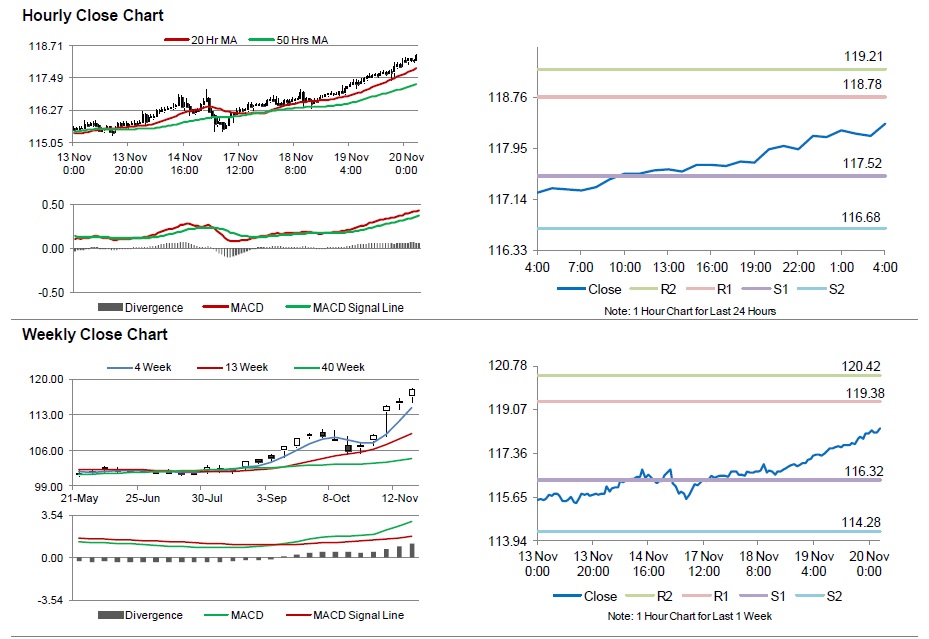

The pair is expected to find support at 117.52, and a fall through could take it to the next support level of 116.68. The pair is expected to find its first resistance at 118.78, and a rise through could take it to the next resistance level of 119.21.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.