For the 24 hours to 23:00 GMT, the USD declined 0.6% against the JPY and closed at 106.70.

In the Asian session, at GMT0400, the pair is trading at 106.90, with the USD trading 0.19% higher against the JPY from yesterday’s close.

Overnight data revealed that Japan’s national consumer price index (CPI) accelerated 1.4% YoY in January, surging to its highest level since July 2014. Market participants had envisaged the CPI to climb 1.3%, after recording a rise of 1.0% in the previous month.

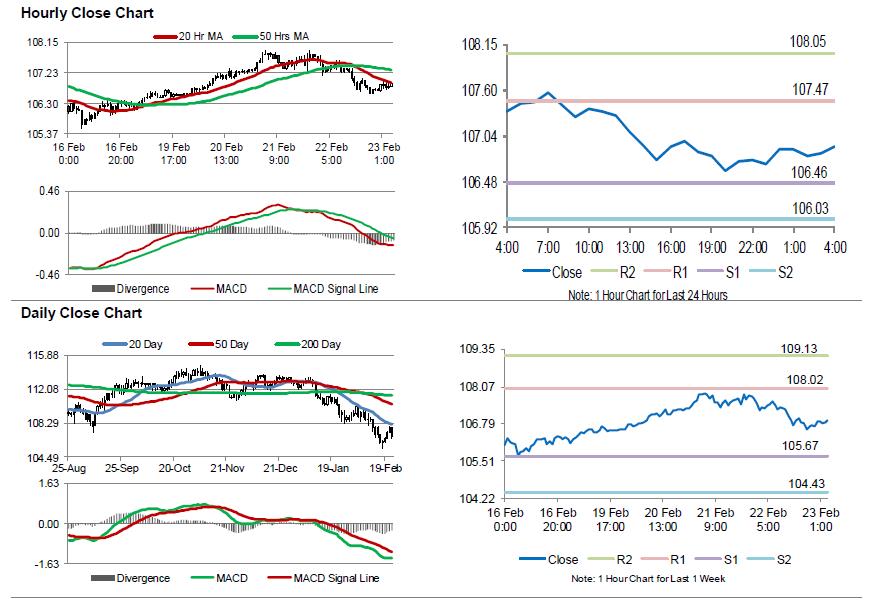

The pair is expected to find support at 106.46, and a fall through could take it to the next support level of 106.03. The pair is expected to find its first resistance at 107.47, and a rise through could take it to the next resistance level of 108.05.

Moving ahead, Japan’s jobless rate, retail trade and consumer confidence index, all due to release next week, would keep investors’ on their toes.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.