On Friday, the USD weakened 0.17% against the JPY and closed at 102.13. The Japanese Yen gained ground as escalating turmoil in Ukraine fuelled demand for safe-haven assets.

Late Sunday, the IMF projected Japan’s growth to ease to 1.0% next year from 1.4% in 2014, as the fund expects stimulus effects in the economy to wear off.

In the Asian session, at GMT0300, the pair is trading at 102.12, with the USD trading tad lower from Friday’s close.

Earlier today, Japanese Finance Minister, Taro Aso opined that Japan needs to stick to its aggressive monetary and fiscal stimulus measures for the time being as it has attributed to the recent weakness in the Japanese Yen.

On the economic front, Japan’s annual retail trade jumped 11.0% in March, the fastest pace in 17 years, compared to a 3.6% increase seen in the preceding month. Additionally, sales from Japanese large retailers surged 16.1% (YoY) last month, following a 1.3% gain in February.

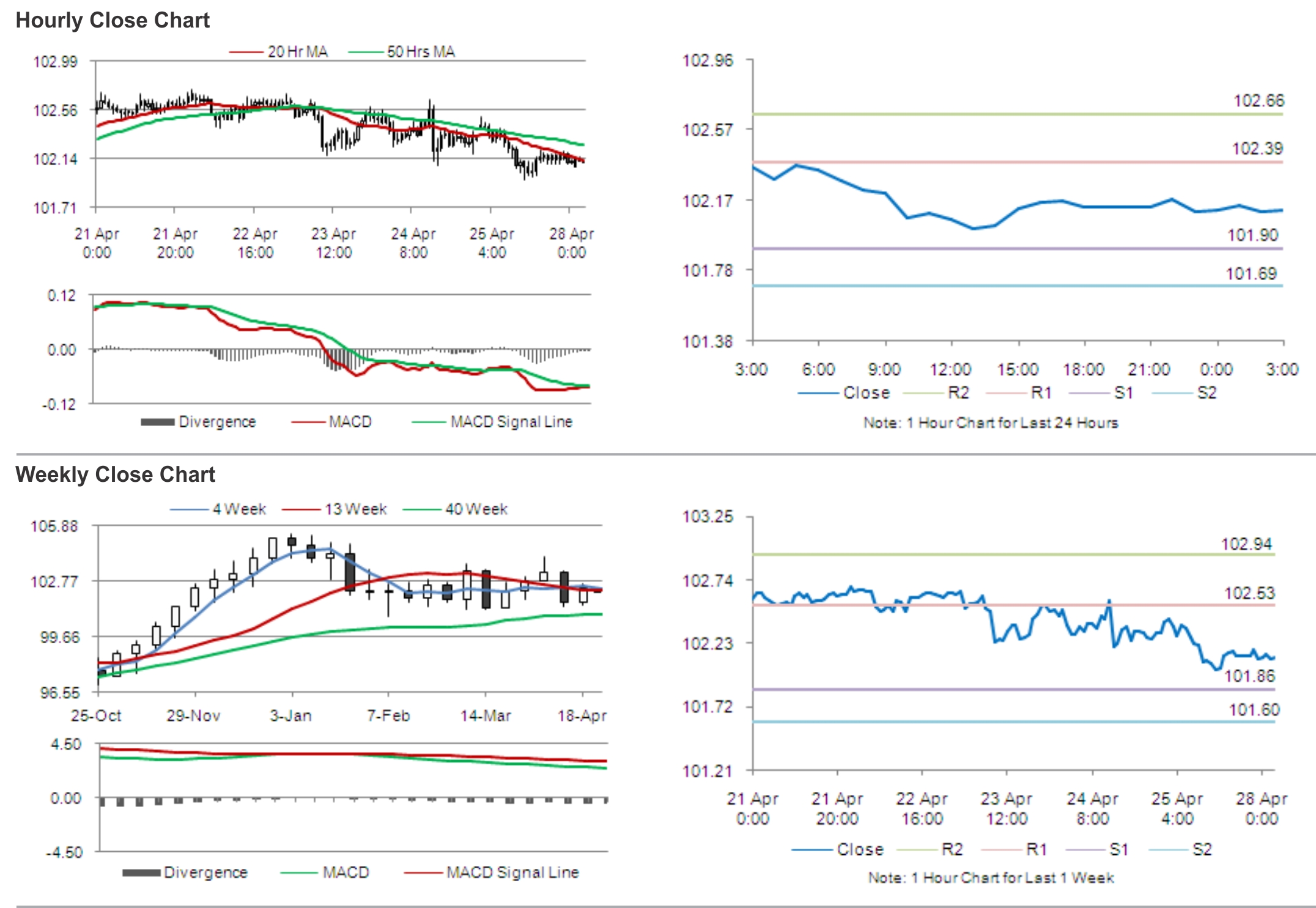

The pair is expected to find support at 101.90, and a fall through could take it to the next support level of 101.69. The pair is expected to find its first resistance at 102.39, and a rise through could take it to the next resistance level of 102.66.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.