For the 24 hours to 23:00 GMT, the USD declined 1.11% against the JPY and closed at 108.36 on Friday.

Data showed that Japan’s annualised housing starts dropped 5.7% on a yearly basis in April, more than market consensus for a fall of 0.6%. Housing starts had registered a rise of 10.0% in the prior month. Moreover, the consumer confidence index unexpectedly fell to a level of 39.4 in May, defying market expectations for an advance to a level of 40.7. In the prior month, the index had registered a level of 40.4. Further, the nation’s construction orders tumbled 19.9% on an annual basis in April, following a gain of 66.1% in the preceding month.

In the Asian session, at GMT0300, the pair is trading at 108.13, with the USD trading 0.21% lower against the JPY from Friday’s close. Overnight data showed that Japan’s final Nikkei manufacturing PMI eased to 49.8 in May, compared to a reading of 50.2 in the previous month. The preliminary figures had recorded a drop to 49.6.

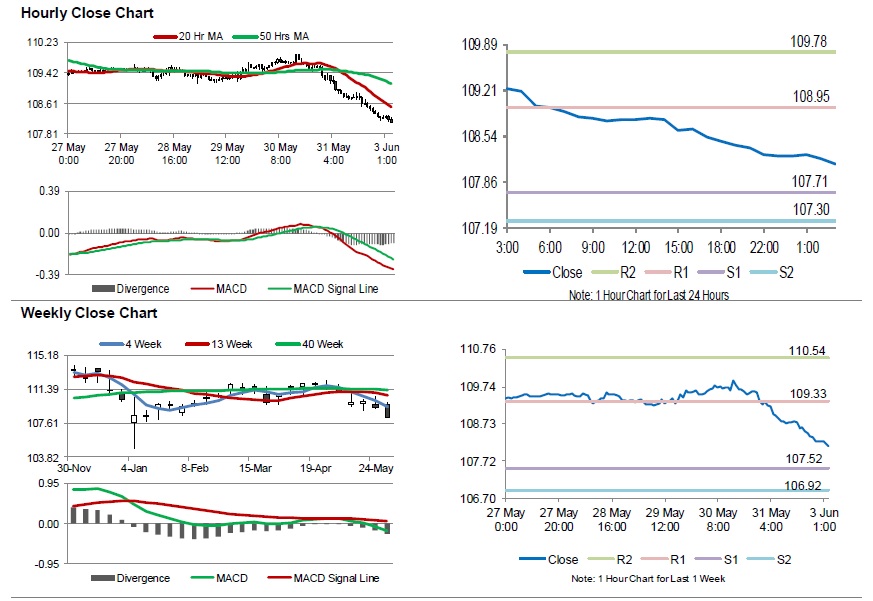

The pair is expected to find support at 107.71, and a fall through could take it to the next support level of 107.30. The pair is expected to find its first resistance at 108.95, and a rise through could take it to the next resistance level of 109.78.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.