For the 24 hours to 23:00 GMT, the USD rose 0.66% against the JPY and closed at 111.75.

Yesterday, the Bank of Japan, in its July monetary policy meeting, kept its key interest rate unchanged at -0.10%, in line with market expectations and pledged to keep rates low for an extended period of time. Additionally, the bank adopted forward guidance for policy rates and announced that it will conduct government bond buying in a flexible manner. Meanwhile, the central bank maintained its growth forecast for both 2019 and 2020 at 0.8%.

On the data front, Japan’s consumer confidence index unexpectedly slid to a level of 43.5 in July, defying market expectations for an advance to 43.8. In the prior month, the index recorded a level of 43.7 in the prior month. Additionally, the nation’s housing starts retreated 7.1% on an annual basis, more than market expectations for a fall of 2.5%. In the prior month, housing starts had registered a rise of 1.3%. Moreover, Japan’s construction orders eased 6.5% in June, after registering a drop of 18.7% in the preceding month.

In the Asian session, at GMT0300, the pair is trading at 111.88, with the USD trading 0.12% higher against the JPY from yesterday’s close.

Overnight data revealed that Japan’s final manufacturing PMI slid to a level of 52.3 in July, compared to a level of 53.0 in the previous month. The preliminary figures had indicated a drop to a level of 51.60.

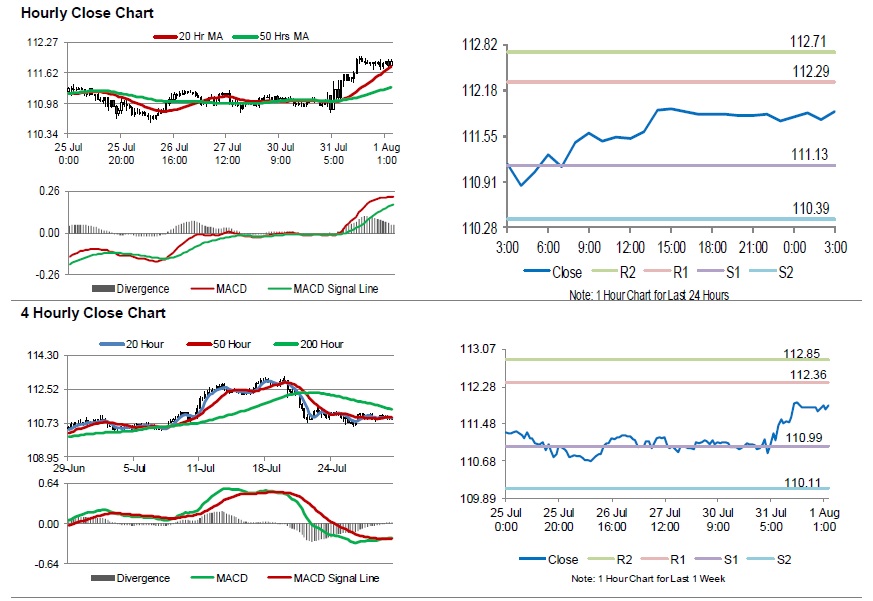

The pair is expected to find support at 111.13, and a fall through could take it to the next support level of 110.39. The pair is expected to find its first resistance at 112.29, and a rise through could take it to the next resistance level of 112.71.

Amid lack of macroeconomic releases in Japan today, investor sentiment will be determined by global macroeconomic cues.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.