For the 24 hours to 23:00 GMT, the USD weakened 0.07% against the JPY and closed at 102.63.

In economic news, Japan’s leading index fell less-than-estimated in February to a near a six-month low reading of 108.9 while the coincident index declined more than market expectations to a level of 113.0 in February.

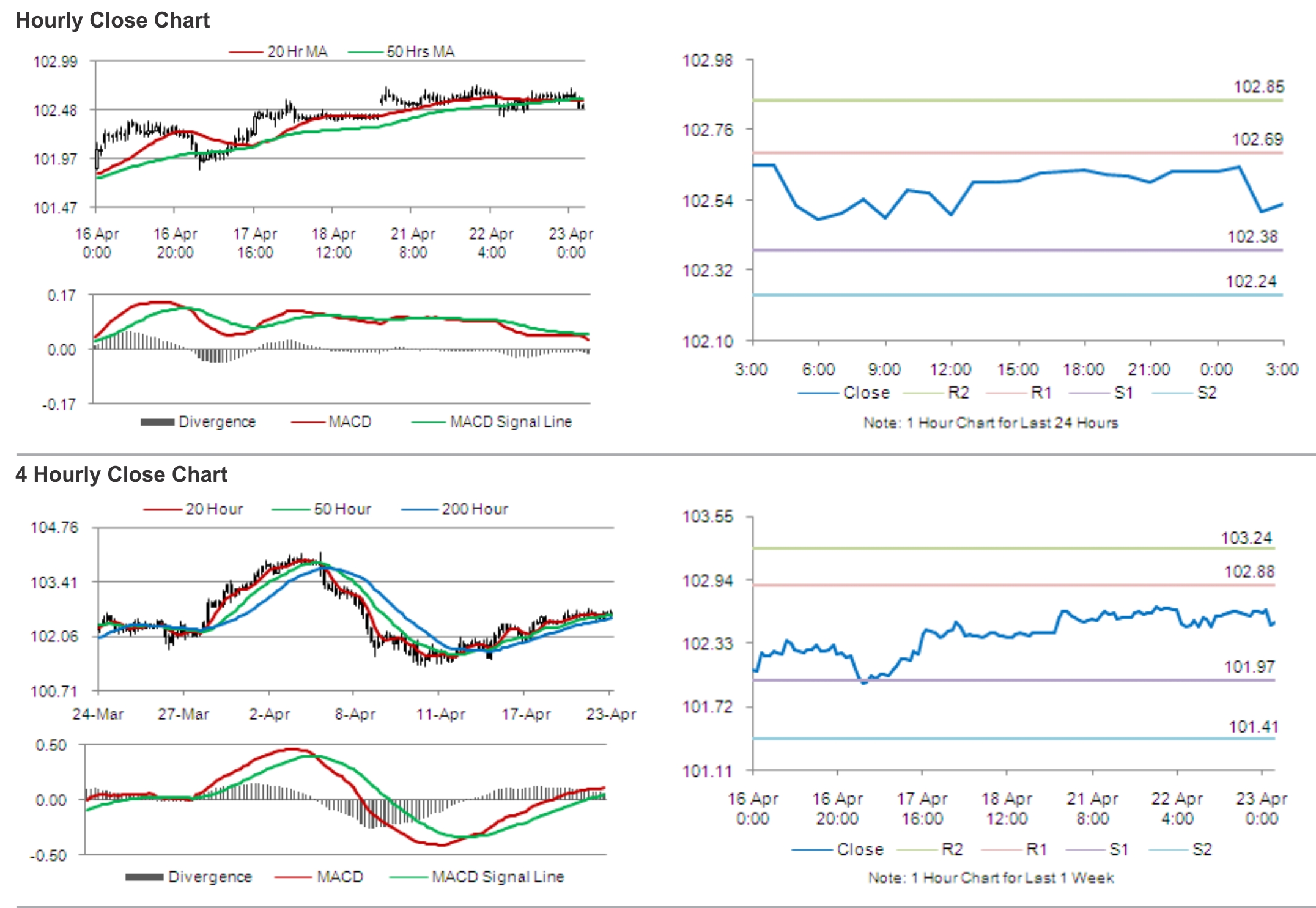

In the Asian session, at GMT0300, the pair is trading at 102.53, with the USD trading 0.10% lower from yesterday’s close.

Earlier today, the Bank of Japan (BoJ) Governor, Haruhiko Kuroda highlighted his expectations for consumer inflation rate in Japan to be slightly higher than the central bank’s current projection of 0.7% in fiscal year 2013. Furthermore, he stated that the central bank does not intend to continue buying bonds just to keep government debt-servicing costs down even after the nation achieves its 2% inflation target. Separately, the BoJ Deputy Governor, Hiroshi Nakaso opined that the Japanese economy is well able to withstand the effects of a consumption tax hike amid continued improvement in its employment and income conditions.

The pair is expected to find support at 102.38, and a fall through could take it to the next support level of 102.24. The pair is expected to find its first resistance at 102.69, and a rise through could take it to the next resistance level of 102.85.

The currency pair is trading just below its 20 Hr and 50 Hr moving averages.