For the 24 hours to 23:00 GMT, the USD declined 0.42% against the JPY and closed at 112.39.

In the Asian session, at GMT0300, the pair is trading at 112.67, with the USD trading 0.25% higher against the JPY from yesterday’s close.

Overnight data revealed that Japan’s national consumer price index (CPI) rose 0.7% on an annual basis in August, surpassing market consensus for a gain of 0.6%. The CPI had climbed 0.4% in the prior month. Further, the nation’s unemployment rate remained steady at 2.8% in August, meeting market expectations. Moreover, the nation’s preliminary industrial production rebounded more-than-anticipated by 2.1% on a monthly basis in August, compared to market expectations for an advance of 1.8%. In the previous month, industrial production had recorded a drop of 0.8%.

In other economic news, Japan’s retail trade registered a more-than-expected drop of 1.7% in August, while markets had envisaged for a fall of 0.5% and following a rise of 1.1% in the previous month. On the contrary, the nation’s large retailers’ sales rebounded 0.6% in August, compared to a fall of 0.2% in the prior month, while markets were expecting for an advance of 0.3%.

Separately, the Bank of Japan’s (BoJ) summary of opinions report showed that one policymaker urged for expanding monetary stimulus at the central bank’s September meeting, while most officials remained in favour of maintaining the current stimulus programme, as the bank was far from achieving the 2.0% inflation target.

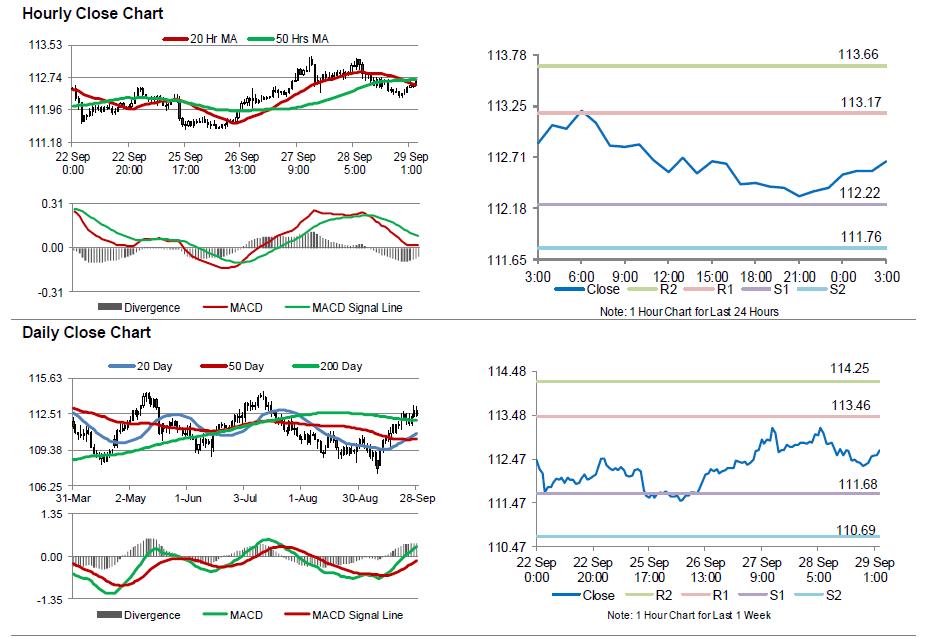

The pair is expected to find support at 112.22, and a fall through could take it to the next support level of 111.76. The pair is expected to find its first resistance at 113.17, and a rise through could take it to the next resistance level of 113.66.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.