For the 24 hours to 23:00 GMT, the USD weakened marginally against the JPY and closed at 101.74, hurt by a dismal US GDP data for the first quarter of 2014.

In the Asian session, at GMT0300, the pair is trading at 101.55, with the USD trading 0.18% lower from yesterday’s close.

Early morning, data showed that Japan’s annual consumer price index rose 3.4% as core consumer prices in the nation rose at their fastest pace since February 1991 in April. Meanwhile, unemployment rate in Japan remained steady at 3.6% in April, in-line with expectations while overall household spending and industrial production missed economists’ projections, following the recent sale-tax hike.

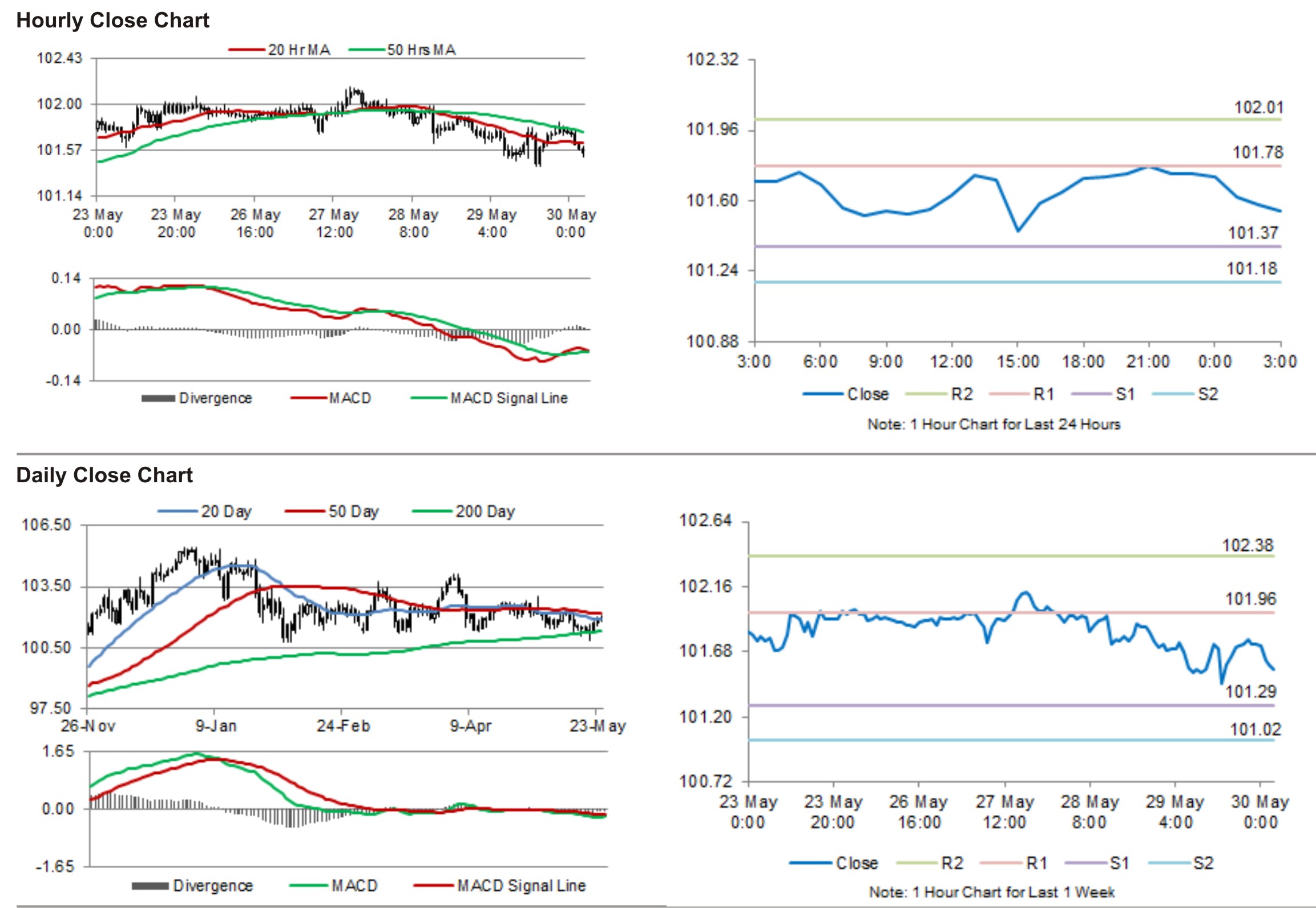

The pair is expected to find support at 101.37, and a fall through could take it to the next support level of 101.18. The pair is expected to find its first resistance at 101.78, and a rise through could take it to the next resistance level of 102.01.

During the later course of the day, traders would eye Japan’s housing starts and construction orders data, for further guidance in the Japanese Yen.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.