For the 24 hours to 23:00 GMT, the USD rose 0.54% against the JPY and closed at 101.74.

In the Asian session, at GMT0300, the pair is trading at 102.11, with the USD trading 0.36% higher against the JPY from Friday’s close.

Overnight data indicated that, Japan’s current account surplus dropped more-than-expected to a level of ¥974.4 billion in June, hitting its lowest level since January, following a current account surplus of ¥1809.1 billion in the previous month while markets anticipated the nation to post a current account surplus of ¥1103.5 billion. Additionally, the nation’s trade surplus, on a BOP basis, widened less-than-anticipated to a level of ¥763.6 billion in June, compared to market expectations of a trade surplus of ¥773.3 billion and following a trade surplus of ¥39.9 billion in the previous month.

Earlier today, data indicated that Japan’s Eco Watchers Survey for the current situation advanced more-than-expected to a level of 45.1 in July, compared to market expectations of a rise to a level of 42.5 and after registering a level of 41.2 in the preceding month. Further, the Eco Watchers Survey for the future outlook rose more-than-anticipated to a level of 47.1 in July, compared to market expectations for a rise to a level of 42.0 and following a reading of 41.5 in the prior month.

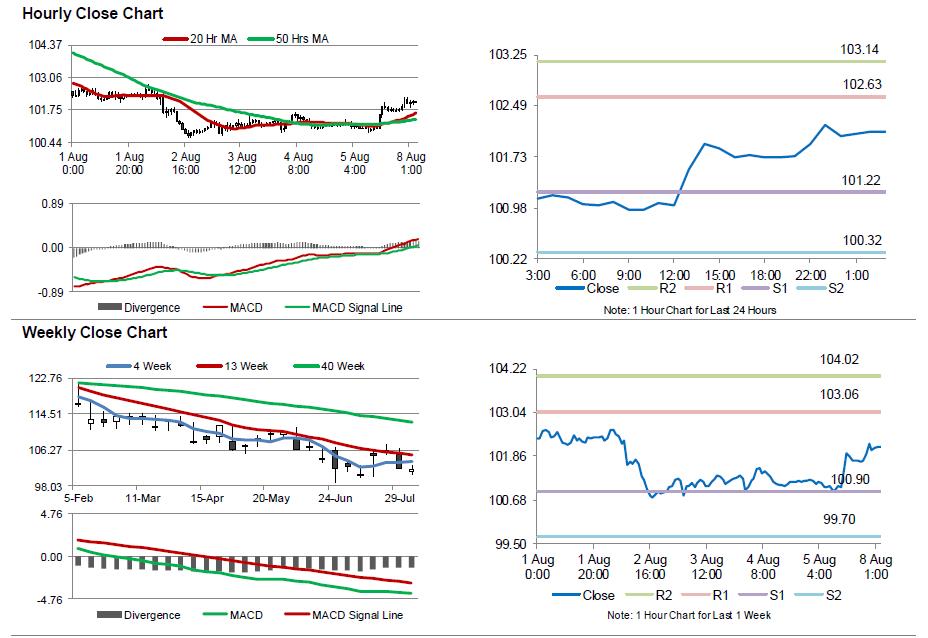

The pair is expected to find support at 101.22, and a fall through could take it to the next support level of 100.32. The pair is expected to find its first resistance at 102.63, and a rise through could take it to the next resistance level of 103.14.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.