For the 24 hours to 23:00 GMT, the USD declined 0.40% against the JPY and closed at 109.73.

In the Asian session, at GMT0300, the pair is trading at 109.78, with the USD trading 0.05% higher from yesterday’s close.

The Japanese yen declined against the USD, after the nation’s final annualised gross domestic product (GDP) recorded a drop of 0.6% on a quarterly basis in the first quarter of 2018, confirming the preliminary print. In the previous quarter, GDP had registered a revised rise of 0.6%, while market participants had expected a fall of 0.4%.

Moreover, the nation’s trade surplus (BOP basis) narrowed more-than-expected to ¥573.80 billion in April, following a surplus of ¥1190.70 billion in the prior month. Markets had anticipated the nation’s trade surplus to narrow to ¥742.30 billion.

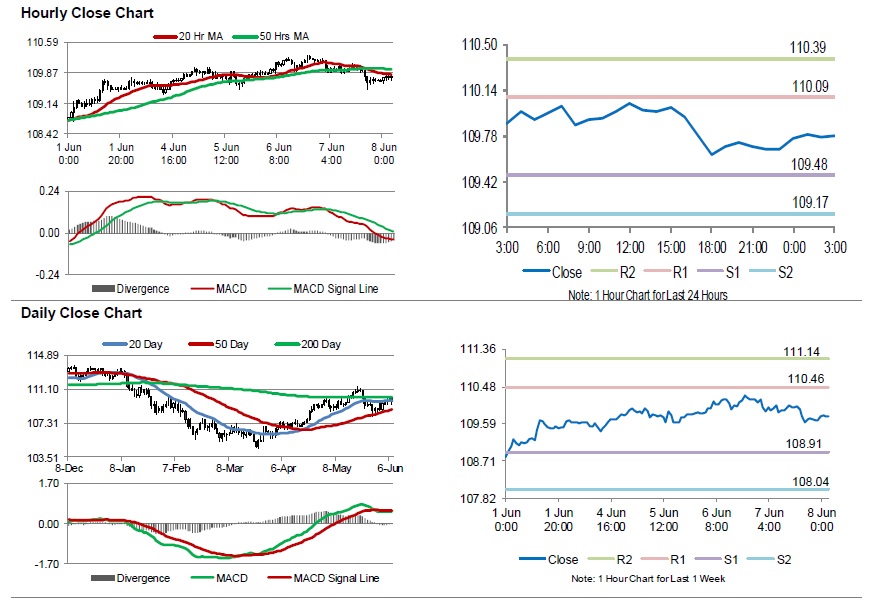

The pair is expected to find support at 109.48, and a fall through could take it to the next support level of 109.17. The pair is expected to find its first resistance at 110.09, and a rise through could take it to the next resistance level of 110.39.

Looking forward, traders would focus on Japan’s machine tool orders, industrial production and interest rate decision, all set to release next week.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.