For the 24 hours to 23:00 GMT, the USD strengthened 0.39% against the JPY and closed at 121.53.

In the Asian session, at GMT0400, the pair is trading at 121.49, with the USD trading marginally lower from yesterday’s close.

The BoJ minutes from its October 6-7 meeting, revealed that a majority of the bank’s board members remained upbeat about Japan’s economic recovery while inflation trend continue to improve. However, many policymakers cautioned that prolonged slowdown in emerging markets could weigh on the nation’s exports. . However, the minutes also signalled that inflation was expected to remain close to flat for the foreseeable future as a result of lower energy prices.

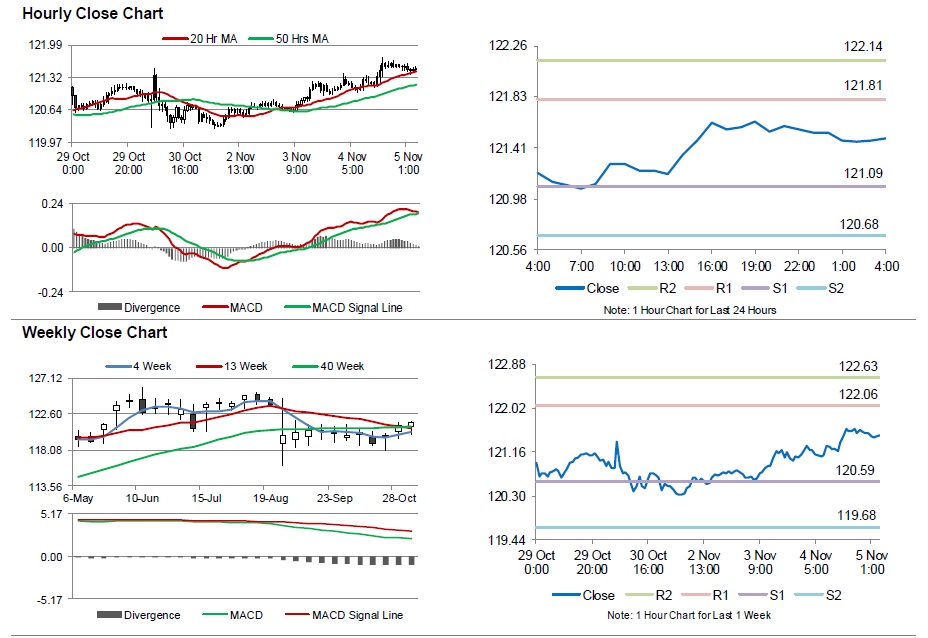

The pair is expected to find support at 121.09, and a fall through could take it to the next support level of 120.68. The pair is expected to find its first resistance at 121.81, and a rise through could take it to the next resistance level of 122.14.

Going ahead, market participants will look forward to Japan’s preliminary leading economic and coincident indices data, both for the month of September, scheduled in the early hours tomorrow. Additionally, a speech by the BoJ Governor, Haruhiko Kuroda, scheduled tomorrow morning, will be closely watched by investors.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.