For the 24 hours to 23:00 GMT, the USD rose 1.07% against the JPY and closed at 105.84 on Friday.

In the Asian session, at GMT0300, the pair is trading at 105.84, with the USD trading flat against the JPY from Friday’s close.

Overnight data showed that Japan’s annualised gross domestic product fell 0.6% on a quarterly basis in 1Q 2020, compared to a similar fall in the previous quarter. Meanwhile, the Jibun Bank manufacturing PMI climbed to 45.2 in July, compared to a reading of 40.1 in the earlier month. The preliminary figures had recorded a rise to 42.6.

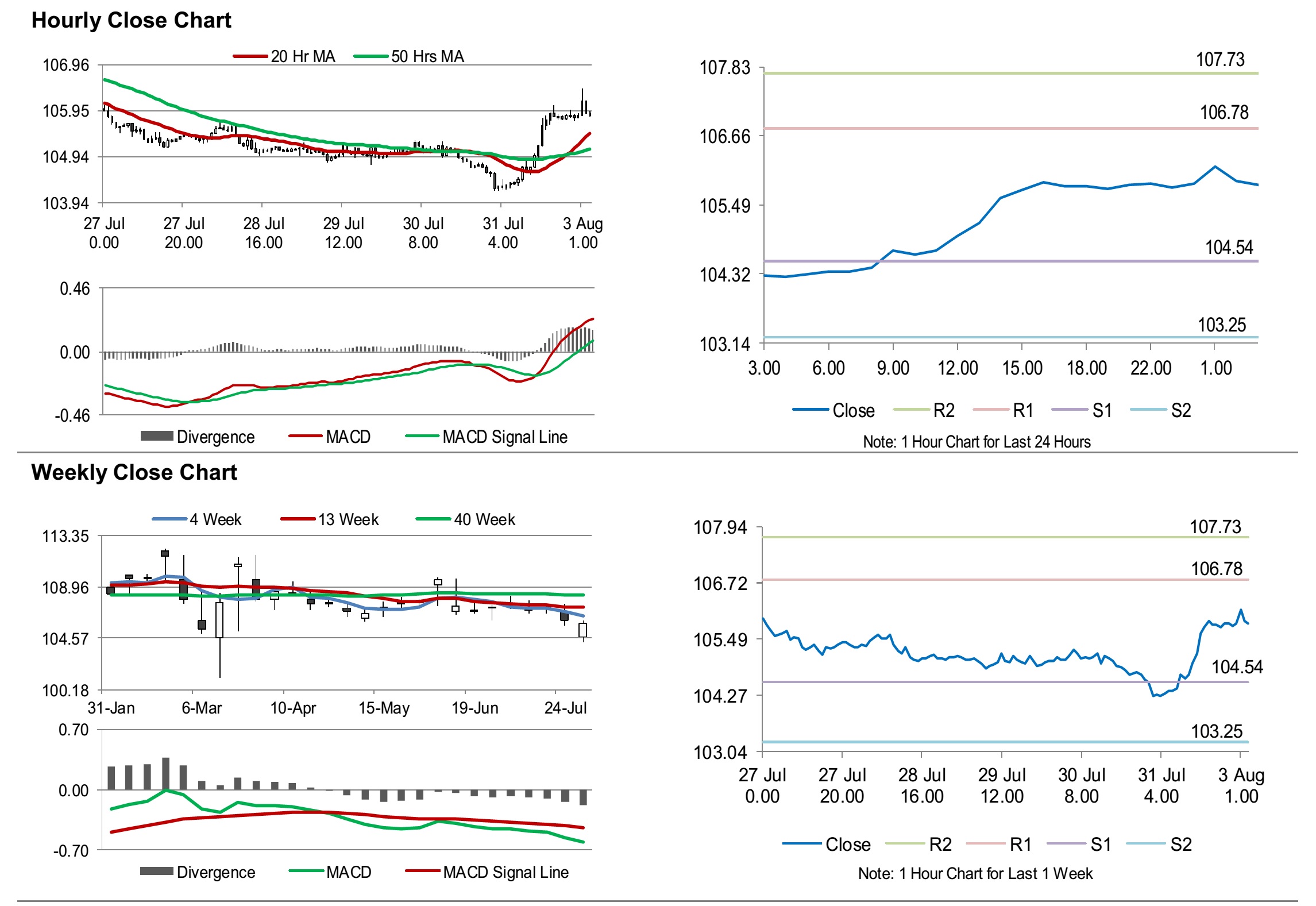

The pair is expected to find support at 104.54, and a fall through could take it to the next support level of 103.25. The pair is expected to find its first resistance at 106.78, and a rise through could take it to the next resistance level of 107.73.

Amid a lack of macroeconomic releases in Japan today, investor sentiment would be determined by global macroeconomic factors.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.