For the 24 hours to 23:00 GMT, the USD strengthened 0.24% against the JPY and closed at 122.93.

In the Asian session, at GMT0400, the pair is trading at 122.44, with the USD trading 0.4% lower from Friday’s close.

Over the weekend, Japan’s preliminary gross domestic product (GDP) fell 0.2% QoQ in 3Q 2015, contracting for the second consecutive quarter. In the prior quarter, GDP had registered a revised similar fall. The contraction was attributed to weakness in business investment and uncertainty over global outlook, thus putting tremendous pressure over the BoJ to boost its fiscal and monetary stimulus, in order to support an ailing economy. Additionally, at an annualized pace, the nation’s GDP recorded a decline of 0.8% during the same period, after registering a drop of 1.2% in the previous quarter.

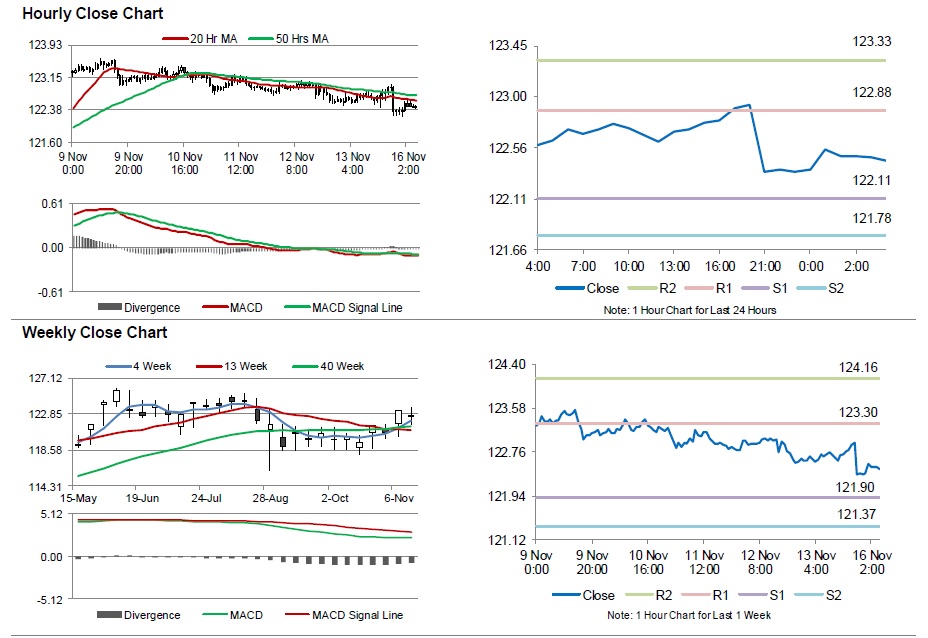

The pair is expected to find support at 122.11, and a fall through could take it to the next support level of 121.78. The pair is expected to find its first resistance at 122.88, and a rise through could take it to the next resistance level of 123.33.

Going ahead, investors will look forward to Japan’s Q3 housing loans data, scheduled to be released overnight.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.