For the 24 hours to 23:00 GMT, the USD weakened 0.72% against the JPY and closed at 101.40. The Japanese Yen rose as the latest batch of mixed economic data from China spurred demand for safe-haven assets.

In the Asian session, at GMT0300, the pair is trading at 101.57, with the USD trading 0.17% higher from yesterday’s close.

Earlier today, the minutes from the Bank of Japan’s (BoJ) March 10-11 policy meeting showed that the Japanese economy and consumer prices are moving in line with the central bank’s expectations and that the recent hike in the nation’s sales tax would not derail consumer spending. The minutes also showed that one of the BoJ’s policymakers opined that a weaker yen is having a much greater impact on pushing up consumer prices than previously estimated. Separately, economic releases from Japan showed that the domestic corporate goods price index registered a flat reading on a monthly basis in March while the M2+CD money supply in the nation rose at a slower pace last month.

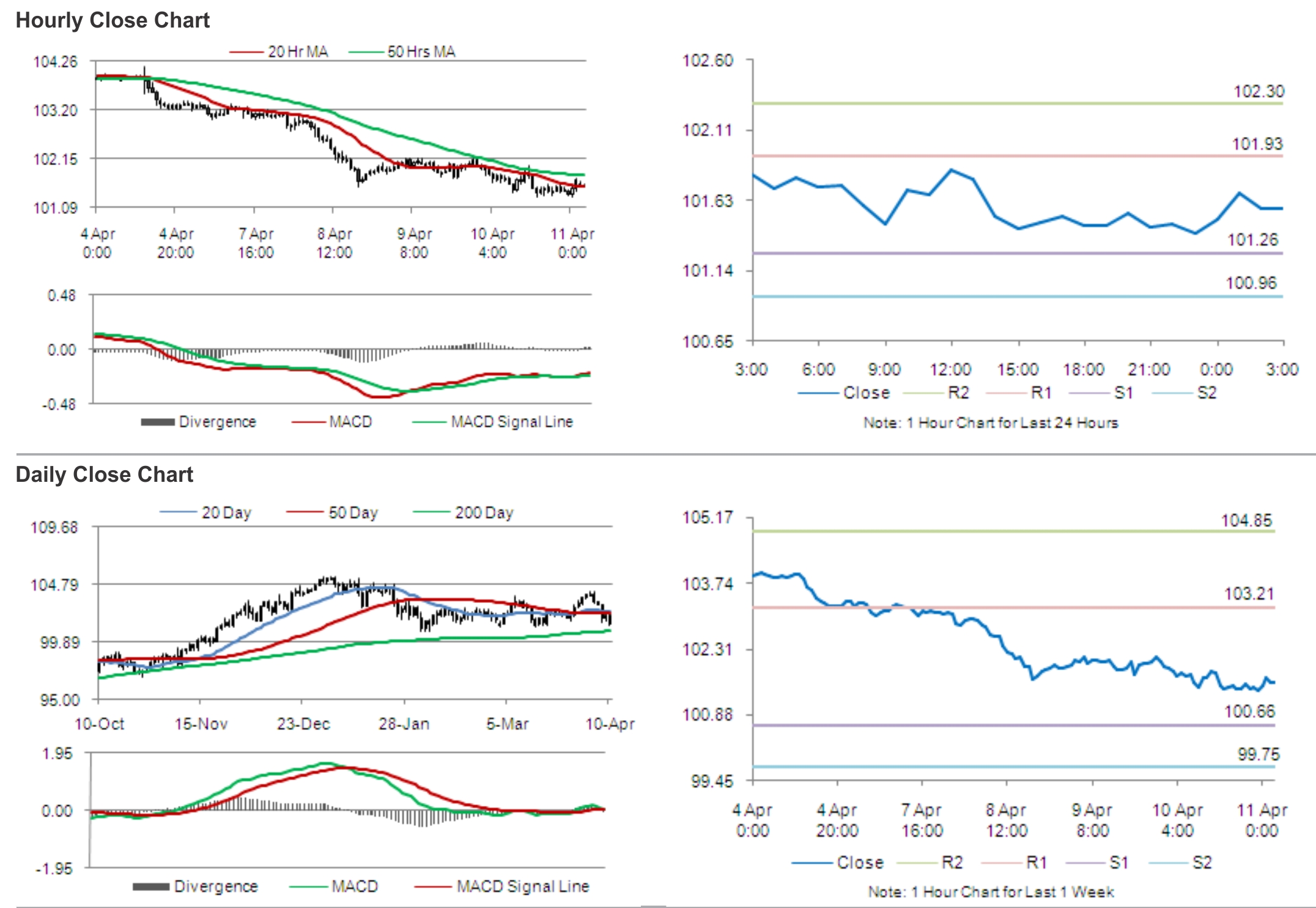

The pair is expected to find support at 101.26, and a fall through could take it to the next support level of 100.96. The pair is expected to find its first resistance at 101.93, and a rise through could take it to the next resistance level of 102.30.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.