For the 24 hours to 23:00 GMT, the USD strengthened 0.60% against the JPY and closed at 122.38.

In the Asian session, at GMT0400, the pair is trading at 122.55, with the USD trading 0.13% higher from yesterday’s close.

Overnight data showed that Japan swung back into trade deficit in November as the merchandise trade balance recorded a deficit of ¥379.7 billion, against expectations for a ¥449.7 billion deficit This comes after a ¥108.3 billion surplus in October, which broke a six-month streak of deficits.

The nation’s exports fell at the fastest pace in almost three years by 3.3%, while imports were down 10.2%, on an annual basis, in November.

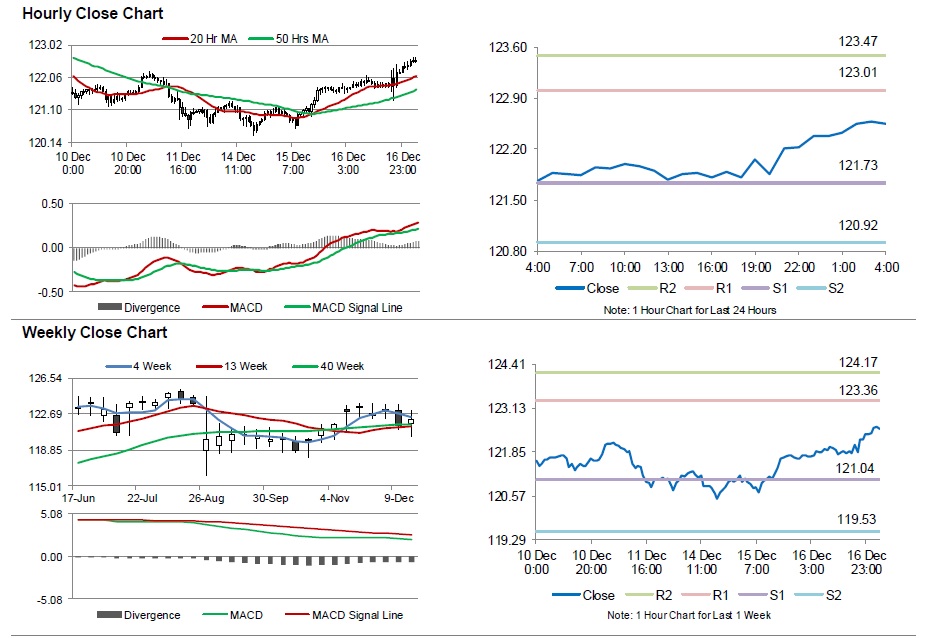

The pair is expected to find support at 121.73, and a fall through could take it to the next support level of 120.92. The pair is expected to find its first resistance at 123.01, and a rise through could take it to the next resistance level of 123.47.

Moving ahead, investors will concentrate on BoJ’s interest rate decision, scheduled to be announced in the early hours tomorrow.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.