On Friday, the USD weakened 0.22% against the JPY and closed at 123.91.

Data released indicated that housing starts in Japan rose more than expected by 16.3% on an annual basis in June, after it registered an increase of 5.8% in the previous month.

In the Asian session, at GMT0300, the pair is trading at 124.00, with the USD trading 0.07% higher from Friday’s close.

Early in the morning, data released showed that Japan’s final estimate of the manufacturing PMI rose to a five-month high reading of 51.2 in July, compared to prior month’s reading of 50.1. However, it slightly fell short of its preliminary reading of 51.4 in July.

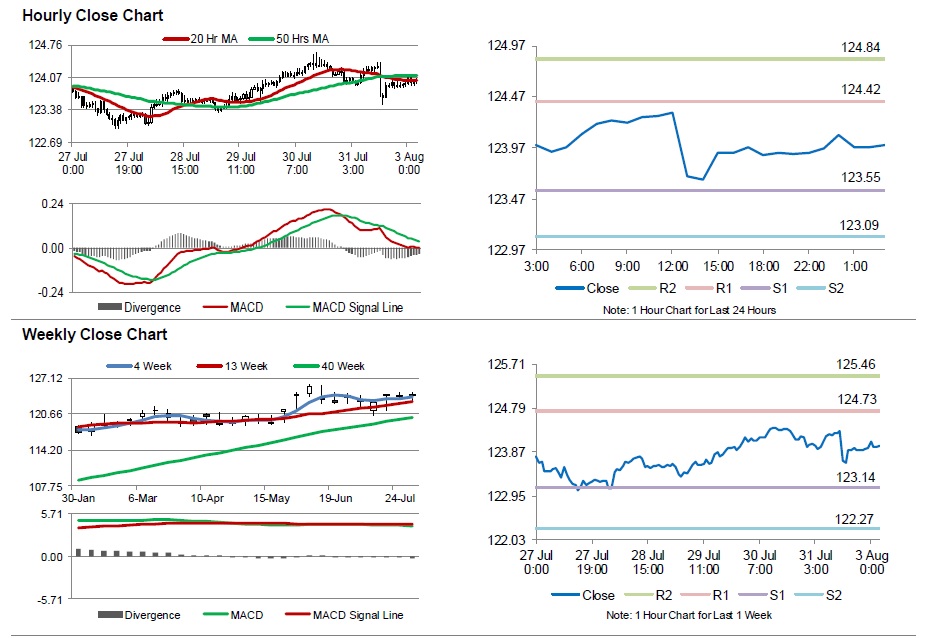

The pair is expected to find support at 123.55, and a fall through could take it to the next support level of 123.09. The pair is expected to find its first resistance at 124.42, and a rise through could take it to the next resistance level of 124.84.

Going ahead, the BoJ monetary policy decision accompanied by the speech of the central bank Governor, Haruhiko Kuroda, scheduled later in the week would keep investors on their toes.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.