For the 24 hours to 23:00 GMT, the USD weakened 0.18% against the JPY and closed at 110.74.

In economic news, Japan’s housing starts advanced to a ten-month high level of 9.0% YoY in April, higher than market expectations for an advance of 4.1% and following an 8.4% rise in the previous month. On the other hand, the nation’s construction orders plummeted 16.9% YoY in April, the steepest fall since October 2015, after registering a 19.8% growth in the previous month.

In the Asian session, at GMT0300, the pair is trading at 110.71, with the USD trading marginally lower from yesterday’s close.

Early this morning, data showed that, Japan’s Nikkei final manufacturing PMI rose to a level of 47.7 in May, compared to the preliminary reading of 47.6. In the prior month, the index had recorded a reading of 48.2.

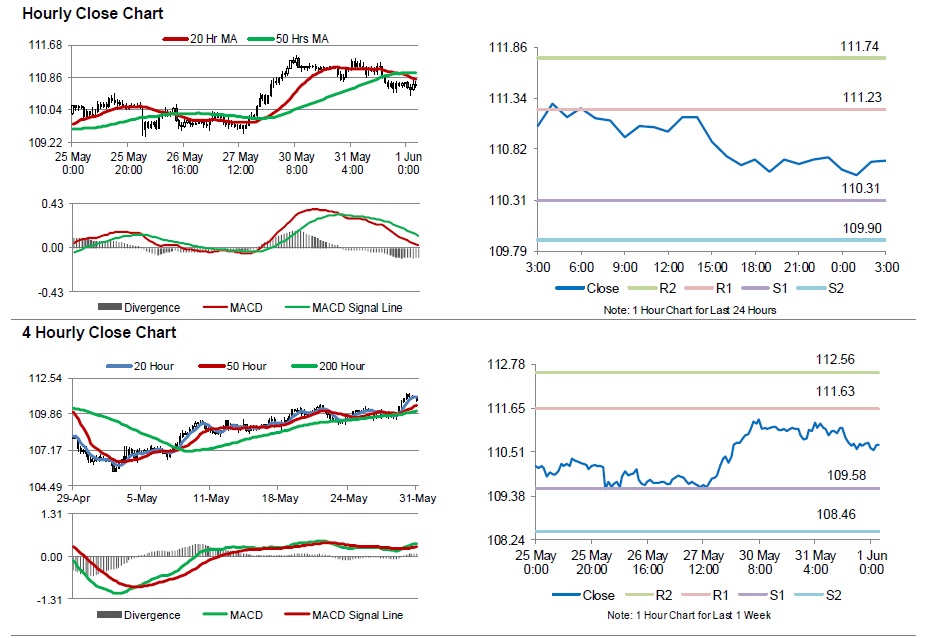

The pair is expected to find support at 110.31, and a fall through could take it to the next support level of 109.90. The pair is expected to find its first resistance at 111.23, and a rise through could take it to the next resistance level of 111.74.

Moving ahead, investors will look forward to Japan’s confidence index data for May, scheduled to release tomorrow morning.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.