For the 24 hours to 23:00 GMT, the USD strengthened 0.12% against the JPY and closed at 119.26.

In economic news, the preliminary estimate of Japan’s leading index came in at a level of 104.9 in July, at par with market expectations and compared to prior month’s reading of 106.5. Additionally, the nation’s coincident index rose to 112.2 in July, matching market forecasts and following a level of 112.3 in June.

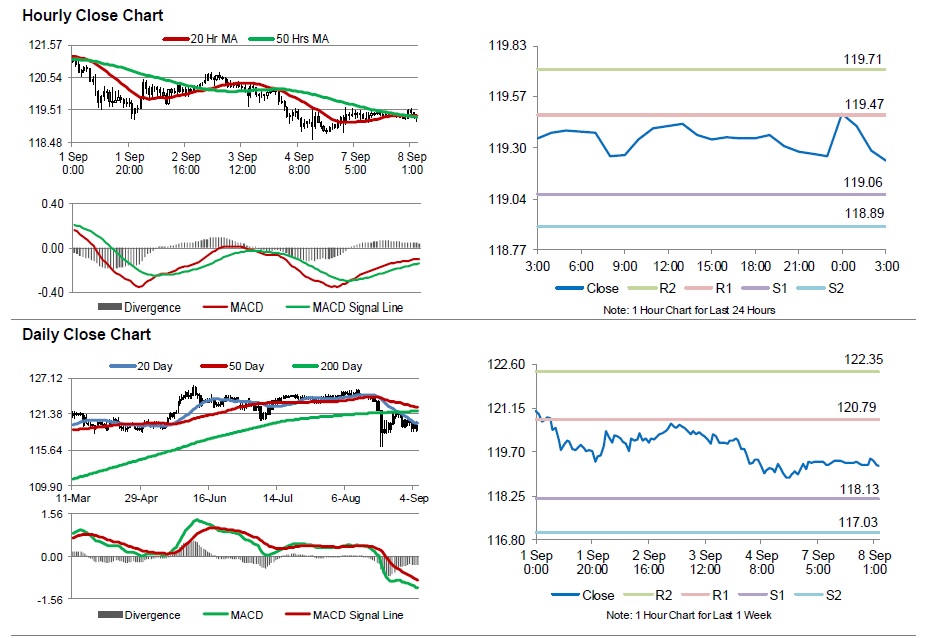

In the Asian session, at GMT0300, the pair is trading at 119.23, with the USD trading marginally lower from yesterday’s close.

Overnight data showed that Japan’s economy contracted less than expected by 0.3% on a QoQ basis in the second quarter, a slight improvement from the previous estimate of 0.4% drop, indicating that the BoJ policymakers would need to do more to drive Japan’s fragile recovery.

Other macroeconomic revealed that Japan’s trade deficit (BOP basis) widened to ¥108.0 billion in July, from a surplus of ¥102.60 billion in June. Meanwhile, markets were expecting the nation to register a trade deficit of ¥80.0 billion in July.

The pair is expected to find support at 119.06, and a fall through could take it to the next support level of 118.89. The pair is expected to find its first resistance at 119.47, and a rise through could take it to the next resistance level of 119.71.

Going forward, market participants would closely monitor Japan’s Eco-watcher’s survey data, scheduled in a few hours for further cues.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.