For the 24 hours to 23:00 GMT, the USD declined 0.08% against the JPY and closed at 106.92 on Friday.

On the macro front, Japan’s flash coincident index unexpectedly eased to a level of 99.8 in Japan, compared to market expectations for a gain of 100.7. In the prior month, the index had registered a revised rise of 99.5. Moreover, the preliminary leading economic index unexpectedly rose to a level of 93.6 in July, compared to a revised level of 93.6 in the prior month. Market participants had anticipated the index to record a drop to a level of 93.2.

In the Asian session, at GMT0300, the pair is trading at 106.90, with the USD trading a tad lower against the JPY from Friday’s close.

Overnight data showed that Japan’s annualised gross domestic product rose 0.3% on a quarterly basis in the 2Q 2019, at par with market expectations. In the preceding quarter, the GDP had recorded a reading of 0.4%. Further, the nation posted a trade deficit of ¥74.5 billion in July, compared to a surplus of ¥759.3 billion in the preceding month. Market participants had envisaged the nation to record a deficit of ¥24.0 billion.

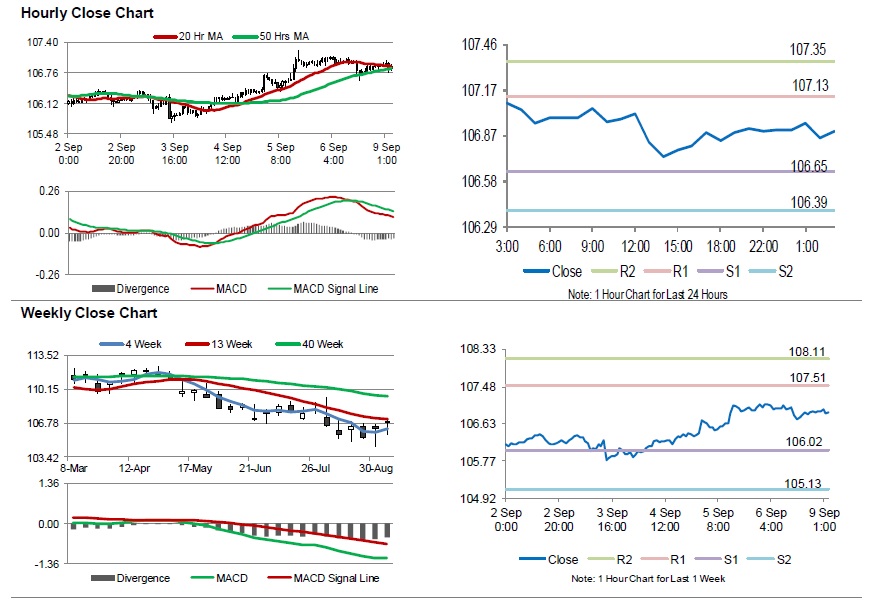

The pair is expected to find support at 106.65, and a fall through could take it to the next support level of 106.39. The pair is expected to find its first resistance at 107.13, and a rise through could take it to the next resistance level of 107.35.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.