For the 24 hours to 23:00 GMT, the USD slightly rose against the JPY and closed at 107.81 on Friday.

In economic news, Japan’s housing starts tumbled 8.7% on an annual basis in May, surpassing market consensus for a drop of 4.2%. In the previous month, housing starts had recorded a drop of 5.7%. Moreover, the nation’s construction orders plunged 16.9% on an annual basis in May, following a fall of 19.9% in the previous month.

In the Asian session, at GMT0300, the pair is trading at 108.23, with the USD trading 0.39% higher against the JPY from Friday’s close.

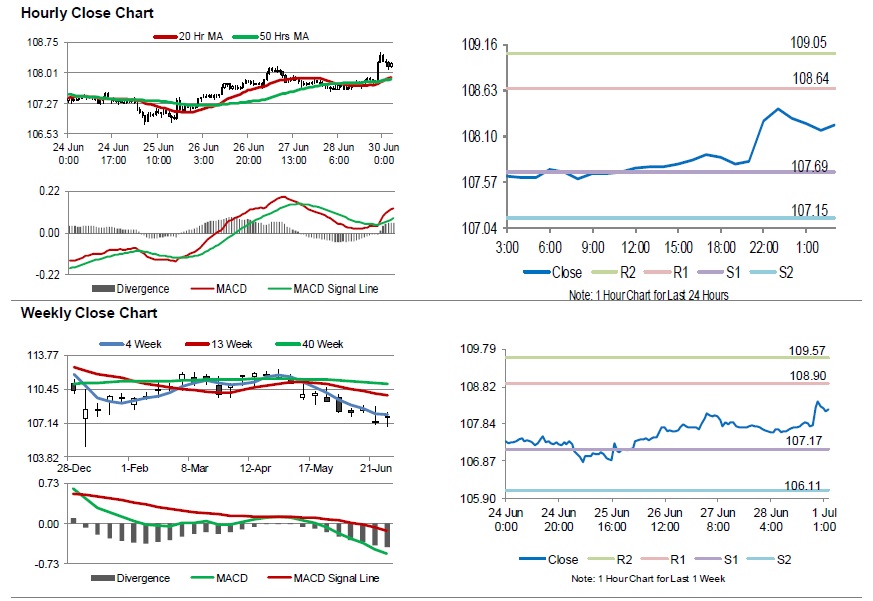

The pair is expected to find support at 107.69, and a fall through could take it to the next support level of 107.15. The pair is expected to find its first resistance at 108.64, and a rise through could take it to the next resistance level of 109.05.

Trading trend in the Japanese Yen today, is expected to be determined by Japan’s consumer confidence index for June, slated to release in a while.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.