For the 24 hours to 23:00 GMT, the USD strengthened 0.17% against the JPY and closed at 122.82.

In the Asian session, at GMT0400, the pair is trading at 122.74, with the USD trading marginally lower from Friday’s close.

Over the weekend, Japan’s retail trade recorded a rise of 1.1% MoM in October, compared to a revised rise of 0.8% in the previous month. Market expectation was for retail trade to climb 0.3%. Also, the nation’s flash industrial production rose at a less-than-expected pace of 1.4% MoM in October, after recording a rise of 1.1% in the previous month, and against investor expectations for it to climb 1.8%.

Early morning data showed that housing starts in Japan declined unexpectedly by 2.5% YoY in October, lower than market expectations for it to remain steady at 2.6%.

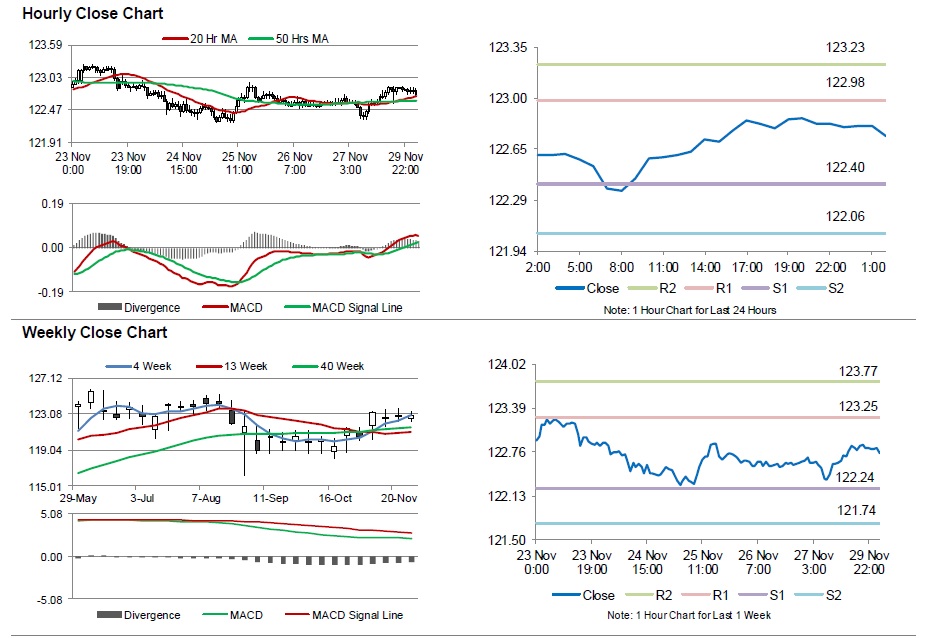

The pair is expected to find support at 122.40, and a fall through could take it to the next support level of 122.06. The pair is expected to find its first resistance at 122.98, and a rise through could take it to the next resistance level of 123.23.

Moving ahead, investors will look forward to the BoJ Governor, Haruhiko Kuroda’s speech and Japan’s Nikkei manufacturing PMI data for November, scheduled to be released tomorrow.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.