For the 24 hours to 23:00 GMT, the USD rose 0.89% against the JPY and closed at 113.93.

In the Asian session, at GMT0400, the pair is trading at 113.32, with the USD trading 0.48% lower from Friday’s close.

Over the weekend, data indicated that Japan’s flash industrial production rebounded by 3.7% MoM in January, registering its fastest gain in a year, following a drop of 1.7% in the preceding month and compared to market expectations for a gain of 3.2%. Additionally, the nation’s seasonally adjusted retail trade unexpectedly fell by 1.1% MoM in January, after recording a revised drop of 0.3% in the preceding month and compared to market consensus for a gain of 0.1%.

Earlier today, data indicated that Japan’s housing starts unexpectedly rose by 0.2% YoY in January, compared to a drop of 1.3% in the previous month and beating investor expectations for a decline of 0.3%.

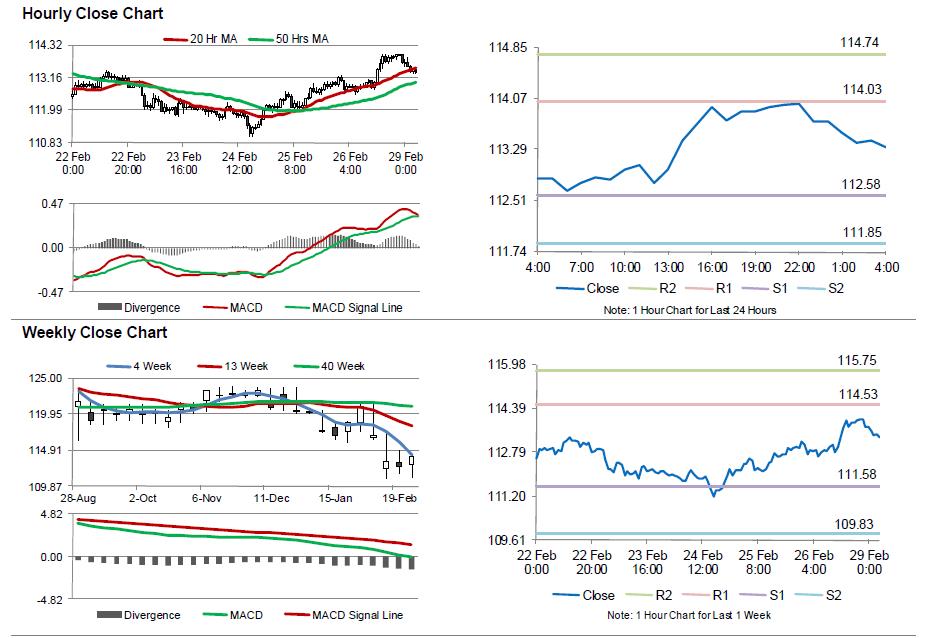

The pair is expected to find support at 112.58, and a fall through could take it to the next support level of 111.85. The pair is expected to find its first resistance at 114.03, and a rise through could take it to the next resistance level of 114.74.

Looking ahead, market participants will keep a close watch on Japan’s unemployment rate data for January, slated to be released overnight, to gauge the strength in the nation’s economy.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.