For the 24 hours to 23:00 GMT, the USD rose 1.52% against the JPY and closed at 109.54.,

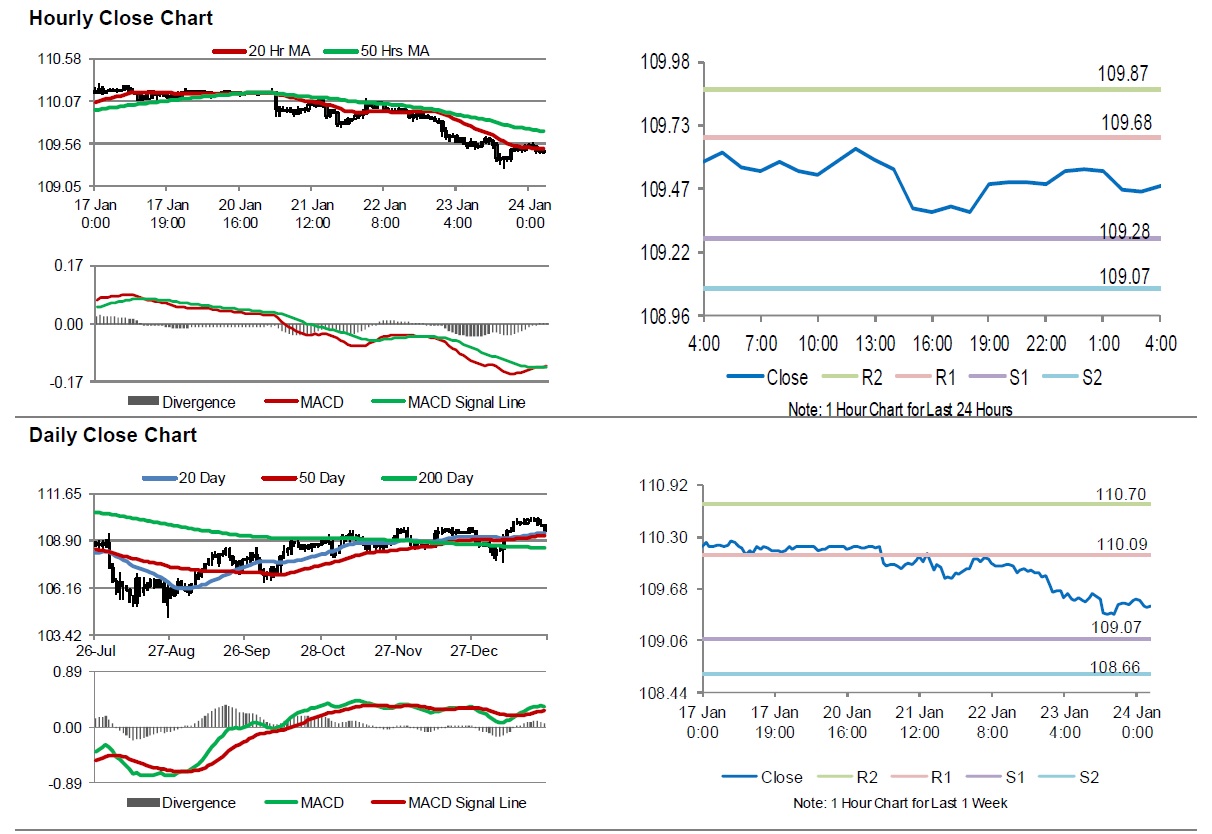

In the Asian session, at GMT0400, the pair is trading at 109.48, with the USD trading 0.05% lower against the JPY from yesterday’s close.

Data showed that Japan’s manufacturing PMI climbed to a level of 49.3 in January, compared to 48.4 in the previous month. Additionally, the nation’s consumer price index unexpectedly rose 0.8% on an annual basis in December, compared to a rise of 0.5% in the previous month. Separately, the Bank of Japan, in its December monetary policy meeting minutes, warned that global uncertainties and last year’s sales tax hike might have hurt capital spending and inflation expectations. Most members agreed that it was appropriate to continue easing consistently. Additionally, Governor Haruhiko Kuroda warned that risks to Japan’s economic recovery remained high.

The pair is expected to find support at 109.28, and a fall through could take it to the next support level of 109.07. The pair is expected to find its first resistance at 109.68, and a rise through could take it to the next resistance level of 109.87.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.