For the 24 hours to 23:00 GMT, the USD strengthened 0.22% against the JPY and closed at 117.87.

In the Asian session, at GMT0400, the pair is trading at 118.29, with the USD trading 0.36% higher from yesterday’s close, after dismal core CPI and retail sales data in Japan.

Early morning data indicated that, Japan’s national CPI rose 2.9% on an annual basis in October, lower than market expectations to advance to a level of 3.0% and compared to a 3.2% increase registered in the previous month. The core CPI, which excludes volatile fresh food prices and the sales tax hike, fell 0.9%, highlighting the challenges facing the BoJ. Meanwhile, the nation’s jobless rate unexpectedly eased to a level of 3.5% in October, lower than market expectations of a steady reading. In the previous month, unemployment rate had recorded a level of 3.6%.

On the other hand, Japan’s industrial production retreated 1.0% on annual basis in October, after registering a rise of 0.8% in September and compared to market expectations of a decline of 1.7%.

Other data showed that the nation’s seasonally adjusted retail trade slid 1.4% on a MoM basis in October, higher than market expectations of a fall of 0.5% and compared to an advance of 2.8% registered in September. Also the nation’s housing starts fell 12.3% on a YoY basis in October, lower than market expected drop of 15.0%

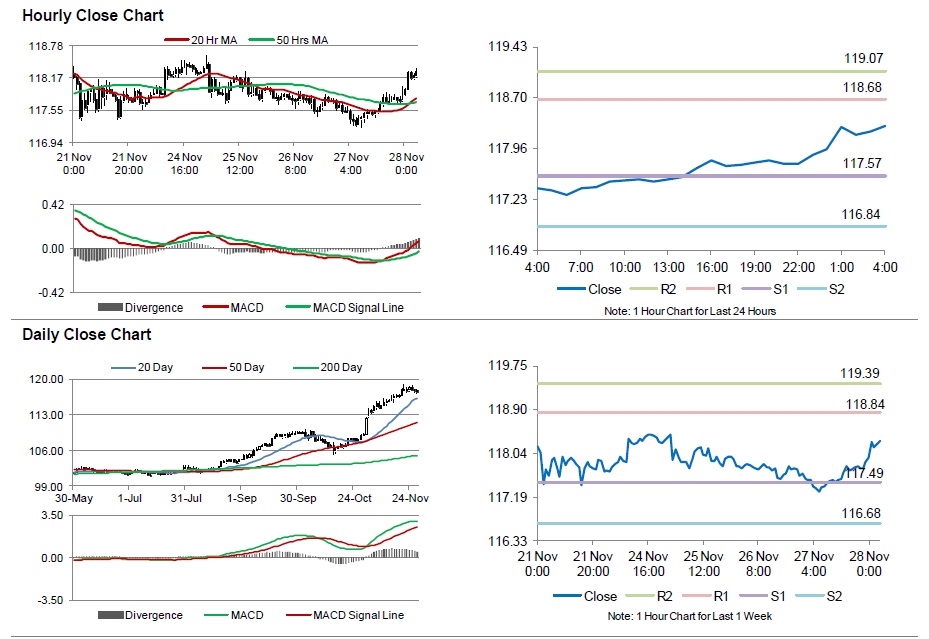

The pair is expected to find support at 117.57, and a fall through could take it to the next support level of 116.84. The pair is expected to find its first resistance at 118.68, and a rise through could take it to the next resistance level of 119.07.

Going forward, market participants await Japan’s manufacturing PMI data to get further insights in the nation’s economy, scheduled in the early hours on Monday.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.