For the 24 hours to 23:00 GMT, the USD strengthened 0.09% against the JPY and closed at 113.44.

On Thursday, data indicated that Japan’s national consumer price index (CPI) rose in line with market expectations by 0.3% YoY in February. In the prior month, the CPI had registered a flat reading, thereby putting pressure on the BoJ to ease monetary policy.

In the Asian session, at GMT0300, the pair is trading at 113.57, with the USD trading 0.12% higher from yesterday’s close.

Overnight data showed that unemployment rate in Japan unexpectedly rose to 3.3% in February, compared to investor expectations for it to remain steady at 3.2%. Moreover, the nation’s seasonal adjusted retail trade declined more-than-expected by 2.3% MoM in February, compared to market expectations for a fall of 0.9% and after registering a revised drop of 0.4% in the previous month.

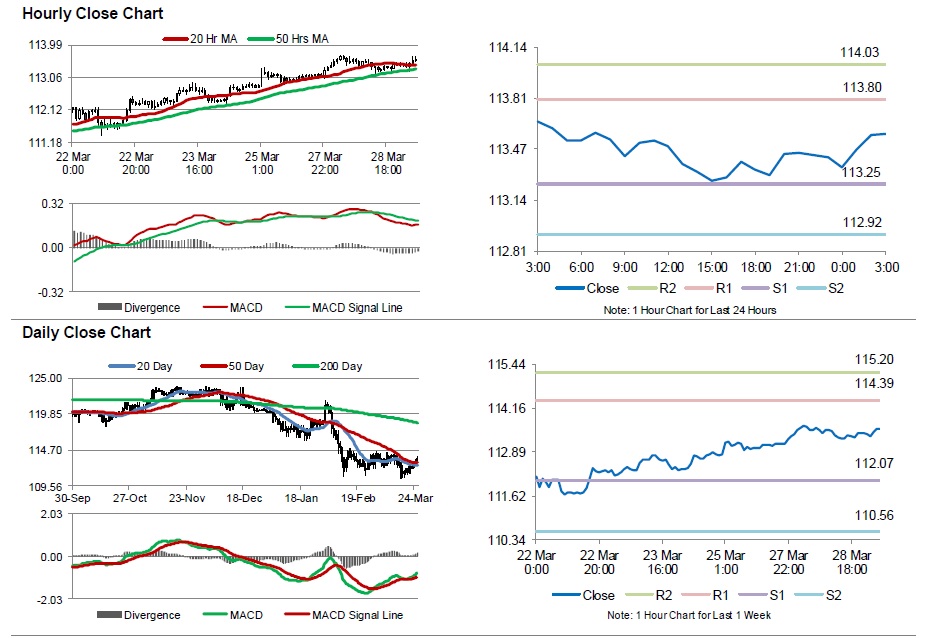

The pair is expected to find support at 113.25, and a fall through could take it to the next support level of 112.92. The pair is expected to find its first resistance at 113.80, and a rise through could take it to the next resistance level of 114.03.

Going ahead, investors will look forward to Japan’s preliminary industrial production data for February, scheduled to release overnight.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.