For the 24 hours to 23:00 GMT, the USD marginally rose against the JPY and closed at 111.25.

In the Asian session, at GMT0300, the pair is trading at 111.1, with the USD trading 0.13% lower against the JPY from yesterday’s close.

Overnight data revealed that Japan’s jobless rate surprisingly remained unchanged at 2.8% in March, compared to market expectation for a rise to 2.9%. Meanwhile, the nation’s national consumer price index (CPI) climbed less-than-anticipated by 0.2% YoY in March, compared to an advance of 0.3% in the prior month, while markets had envisaged for a gain of 0.3%. On the other hand, flash industrial production in Japan slid 2.1% MoM in March, higher than market expectations for a drop of 0.8%. Industrial production had risen 3.2% in the prior month.

Other economic data indicated that the nation’s seasonally adjusted retail trade unexpectedly climbed 0.2% in March, confounding market expectations for a fall of 0.3% and compared to a revised advance of 0.3% in the previous month. In contrast, the nation’s large retailers’ sales fell 0.8% in March, after recording a drop of 2.7% in the prior month.

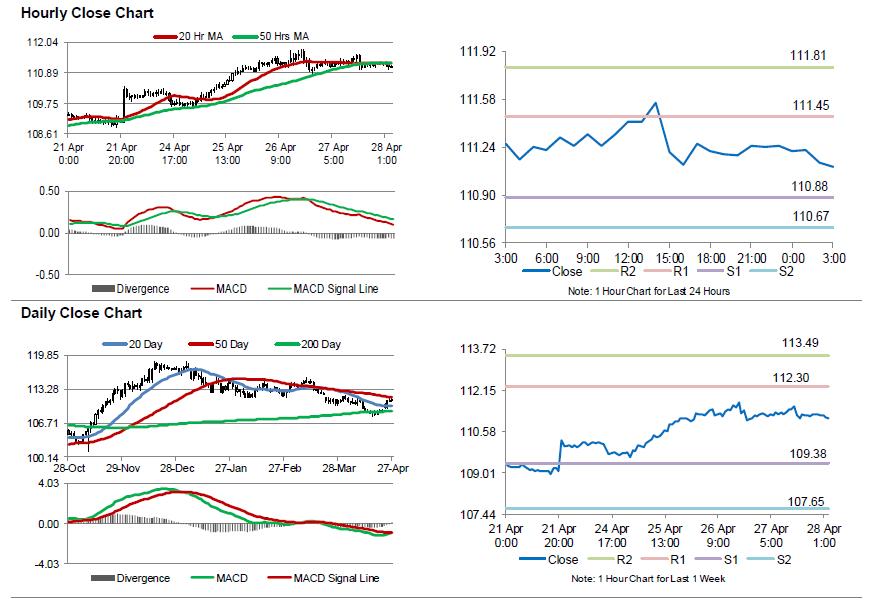

The pair is expected to find support at 110.88, and a fall through could take it to the next support level of 110.67. The pair is expected to find its first resistance at 111.45, and a rise through could take it to the next resistance level of 111.81.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.