For the 24 hours to 23:00 GMT, the USD rose 0.08% against the JPY and closed at 108.95.

In the Asian session, at GMT0400, the pair is trading at 108.83, with the USD trading 0.11% lower against the JPY from yesterday’s close.

Overnight data indicated that Japan’s unemployment rate unexpectedly rose to 2.8% in December, defying market expectations for a steady rate of 2.7%.

On the other hand, the nation’s seasonally adjusted retail trade surprisingly climbed 0.9% on a monthly basis in December, against market anticipation for a fall of 0.4%. Retail trade had risen by a revised 1.8% in the previous month. Also, the nation’s large retailers’ sales jumped 1.1% in December, beating market estimates for a gain of 0.5% and compared to an increase of 1.4% in the preceding month.

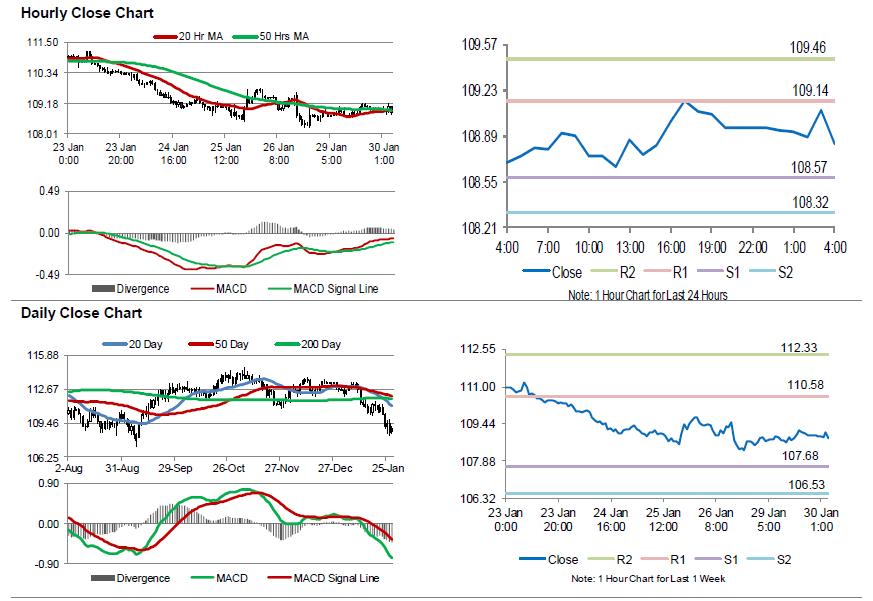

The pair is expected to find support at 108.57, and a fall through could take it to the next support level of 108.32. The pair is expected to find its first resistance at 109.14, and a rise through could take it to the next resistance level of 109.46.

Going forward, the Bank of Japan’s (BoJ) summary of opinions report from its January meeting as well as Japan’s flash industrial production data for December, set to release overnight, would be on investors’ radar.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.