For the 24 hours to 23:00 GMT, the USD rose 0.69% against the JPY and closed at 106.41.

On the data front, Japan’s preliminary coincident index slid to a level of 100.4 in June, in line with market expectations. In the prior month, the index had recorded a reading of 103.4. Moreover, the nation’s flash leading economic index fell to its lowest level in 9.5 years to 93.3 in June, more than market anticipations for a fall to a level of 93.5. In the prior month, the index had recorded a reading of 94.9.

In the Asian session, at GMT0300, the pair is trading at 106.09, with the USD trading 0.30% lower against the JPY from yesterday’s close.

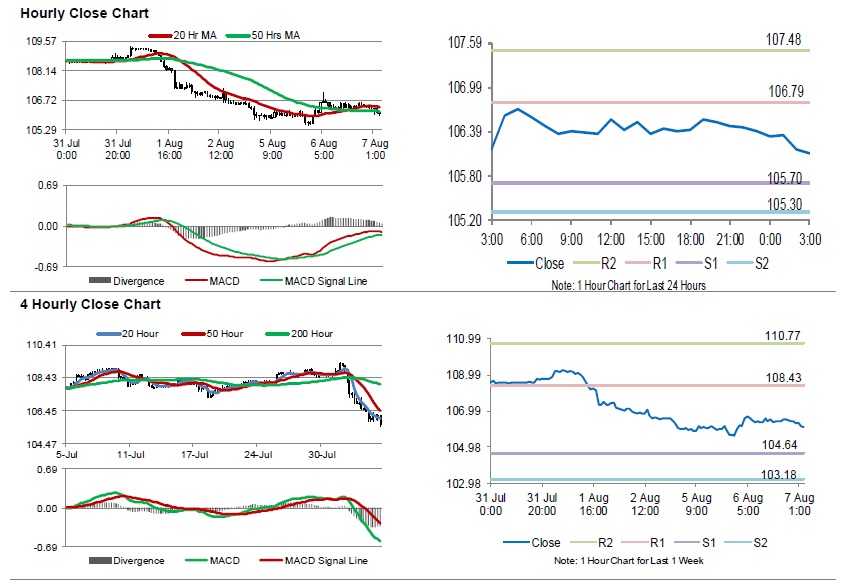

The pair is expected to find support at 105.70, and a fall through could take it to the next support level of 105.30. The pair is expected to find its first resistance at 106.79, and a rise through could take it to the next resistance level of 107.48.

In absence of key economic releases in Japan today, investor sentiment would be determined by global macroeconomic events.

The currency pair is trading below its 20 Hr moving average and showing convergence with its 50 Hr moving average.