For the 24 hours to 23:00 GMT, the USD rose 0.40% against the JPY and closed at 107.24.

Data revealed that Japan’s flash leading economic index fell to a decade low level of 91.7 in August, compared to a level of 93.7 in the prior month. Market participants had expected the index to drop to a level of 93.6. Moreover, the nation’s preliminary coincident index unexpectedly dropped to a level of 99.3 in August, defying market consensus of a rise to a level of 101.1. In the previous month, the index had recorded a reading of 99.7.

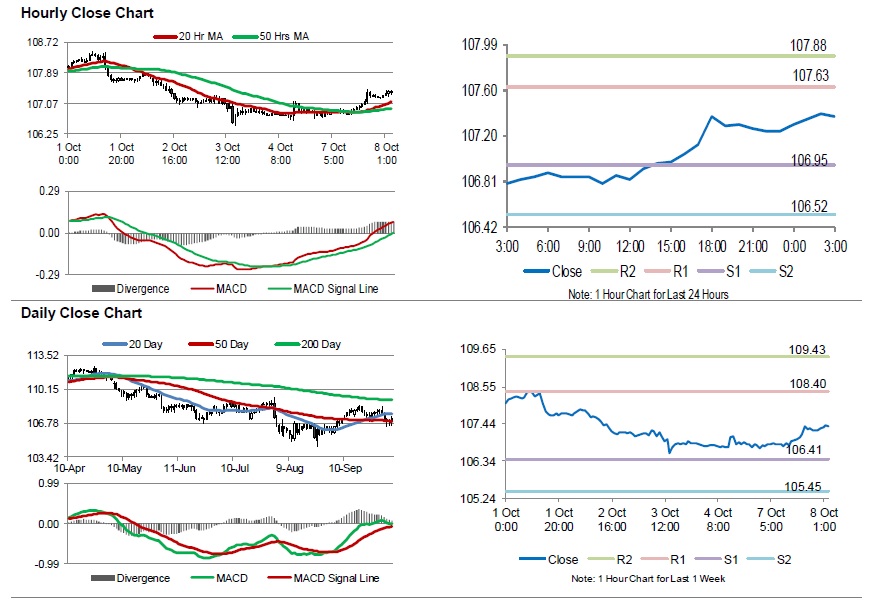

In the Asian session, at GMT0300, the pair is trading at 107.37, with the USD trading 0.12% higher against the JPY from yesterday’s close.

The pair is expected to find support at 106.95, and a fall through could take it to the next support level of 106.52. The pair is expected to find its first resistance at 107.63, and a rise through could take it to the next resistance level of 107.88.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.