For the 24 hours to 23:00 GMT, the USD declined 0.42% against the JPY and closed at 110.90.

In the Asian session, at GMT0300, the pair is trading at 110.79, with the USD trading 0.10% lower against the JPY from yesterday’s close.

Overnight data showed that Japan’s machinery orders plunged 8.8% on a monthly basis in June, more than market expectations for a decline of 1.0% and hitting its largest fall since December 2017. In the previous month, machinery orders had dropped 3.7%. Meanwhile, the nation’s housing loans advanced 2.7% on yearly basis in Q2 2018, after registering a similar rise in the prior quarter.

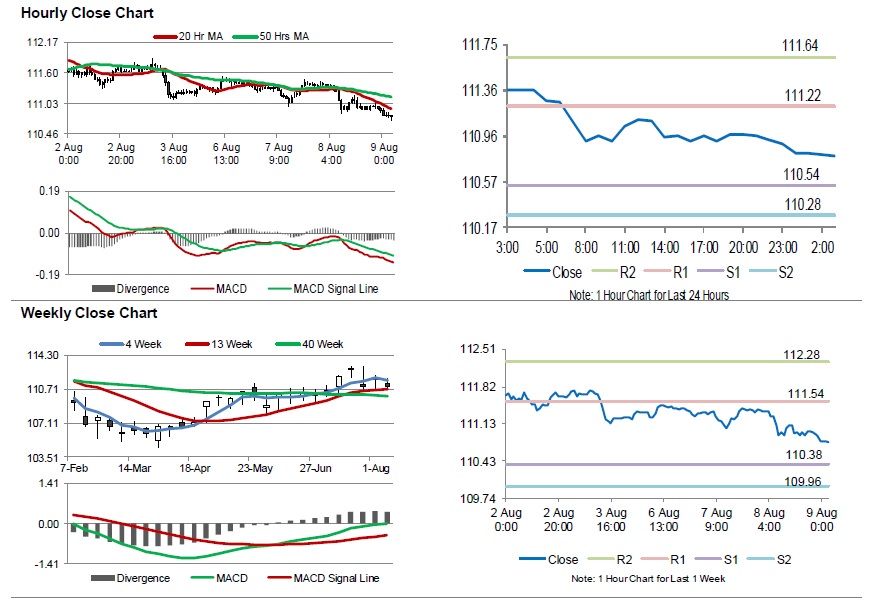

The pair is expected to find support at 110.54, and a fall through could take it to the next support level of 110.28. The pair is expected to find its first resistance at 111.22, and a rise through could take it to the next resistance level of 111.64.

Moving ahead, traders would await Japan’s gross domestic product (GDP) data for Q2, set to release overnight.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.