For the 24 hours to 23:00 GMT, the USD declined 0.55% against the JPY and closed at 107.77 on Friday.

In the Asian session, at GMT0300, the pair is trading at 108.39, with the USD trading 0.58% higher against the USD from Friday’s close.

Overnight data indicated that Japan’s machinery orders rebounded by 8.0% MoM in July, surpassing market expectations for an advance of 4.2%. In the prior month, machinery orders had recorded a drop of 1.9%.

Earlier today, data revealed that the nation’s tertiary industry index rebounded 0.1% in July, in line with market expectations. The index had dropped by a revised 0.2% in the previous month.

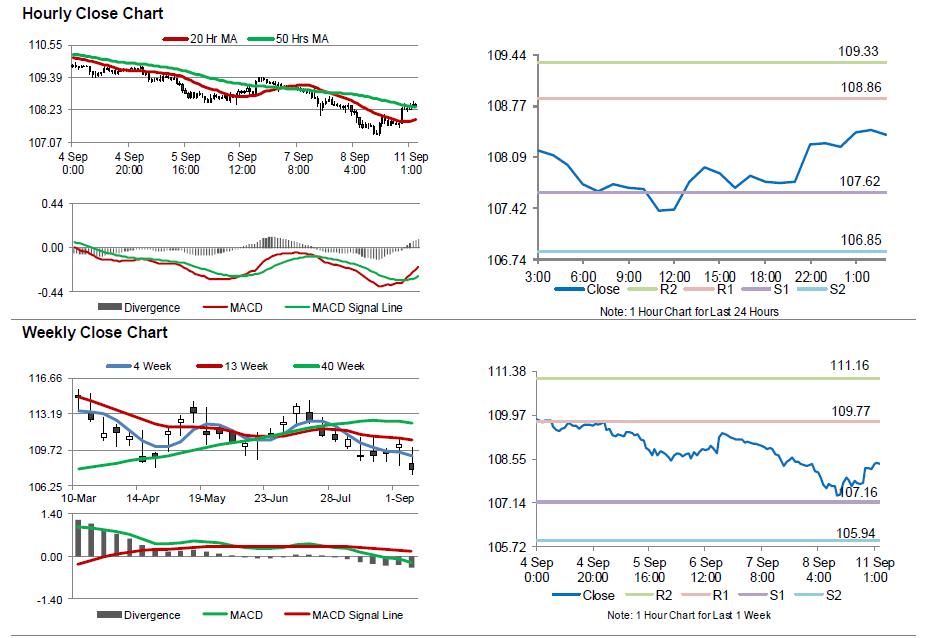

The pair is expected to find support at 107.62, and a fall through could take it to the next support level of 106.85. The pair is expected to find its first resistance at 108.86, and a rise through could take it to the next resistance level of 109.33.

Moving forward, traders will eye Japan’s flash machine tool orders for August, scheduled to release in a while.

The currency pair is trading above its 20 Hr moving average and showing convergence with its 50 Hr moving average.