For the 24 hours to 23:00 GMT, the USD rose 0.39% against the JPY and closed at 103.32.

In economic news, Japan’s housing starts rebounded above expectations by 8.9% YoY in July, following a 2.5% drop in the previous month. On the other hand, the nation’s construction orders declined further by 10.9% YoY in July, after registering a 2.4% fall in the previous month.

In the Asian session, at GMT0300, the pair is trading at 103.24, with the USD trading 0.08% lower against the JPY from yesterday’s close.

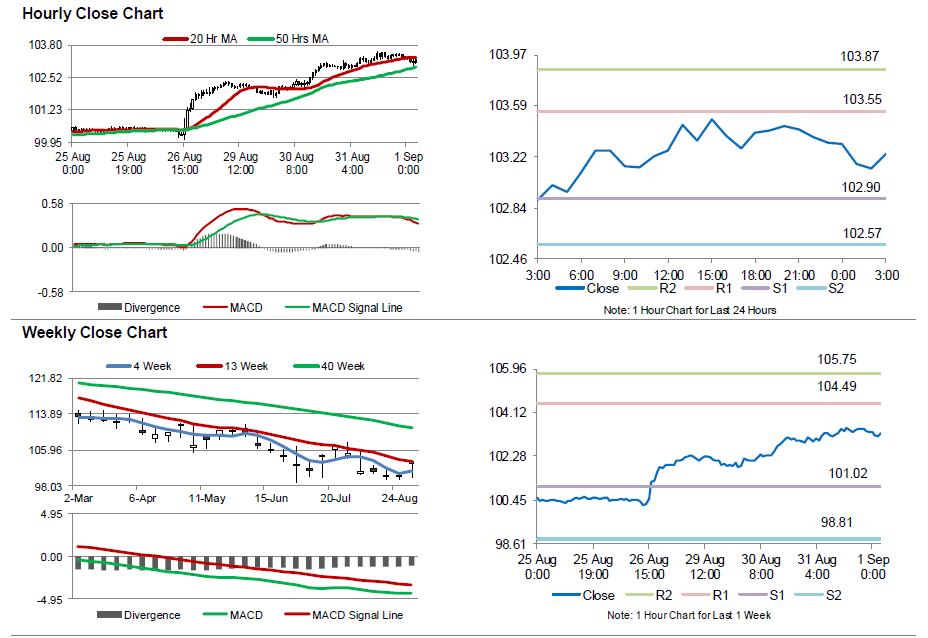

The pair is expected to find support at 102.90, and a fall through could take it to the next support level of 102.57. The pair is expected to find its first resistance at 103.55, and a rise through could take it to the next resistance level of 103.87.

Early this morning, data indicated that, Japan’s final Nikkei manufacturing PMI rose to a level of 49.5 in August, pointing towards a broad slowdown in the world’s third largest economy. In the prior month, manufacturing PMI had recorded a reading of 49.3, while the preliminary figures had recorded a reading of 49.6.

Investors would now concentrate on Japan’s consumer confidence index data for August, due to release tomorrow.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.