For the 24 hours to 23:00 GMT, the USD rose 0.44% against the JPY and closed at 109.37.

In the Asian session, at GMT0300, the pair is trading at 109.22, with the USD trading 0.14% lower against the JPY from yesterday’s close.

The Japanese Yen gained ground, after overnight data revealed that Japan’s flash Nikkei manufacturing PMI jumped to a two-month high level of 52.8 in April, underpinned by a stronger export performance, thus highlighting solid growth in the nation’s manufacturing sector. The PMI had registered a reading of 52.4 in the previous month.

Early morning data indicated that the nation’s tertiary industry index recorded a rise of 0.2% on a monthly basis in February, falling short of market expectations for a rise of 0.3%. In the previous month, the tertiary industry index had recorded a flat reading.

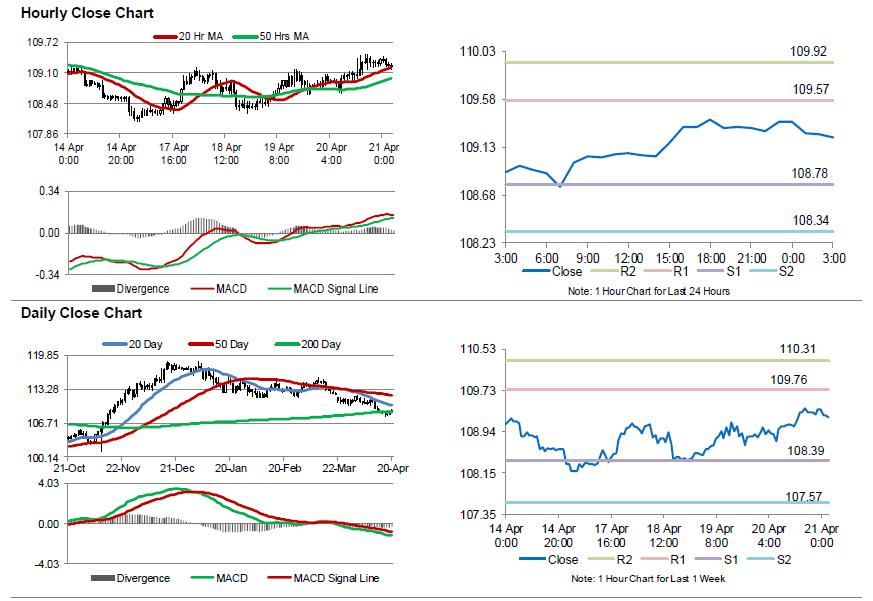

The pair is expected to find support at 108.78, and a fall through could take it to the next support level of 108.34. The pair is expected to find its first resistance at 109.57, and a rise through could take it to the next resistance level of 109.92.

Going ahead, market participants will look forward to Bank of Japan’s interest rate decision, coupled with Japan’s inflation, jobless rate, small business confidence, industrial production and retail trade data, all set to release next week.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.