For the 24 hours to 23:00 GMT, the USD marginally strengthened against the JPY and closed at 104.70.

In the Asian session, at GMT0300, the pair is trading at 104.61, with the USD trading 0.09% lower against the JPY from yesterday’s close.

Early this morning, data showed that Japan’s preliminary Nikkei manufacturing PMI contracted for the fourth consecutive month, recording a reading of 47.8 in June, showing negligible improvement from its level of 47.7 in May.

Separately, the Bank of Japan Board member, Takahide Kiuchi, warned that demerits of the Bank of Japan’s massive monetary stimulus package were outweighing the benefits and that he does not expect inflation to reach the central bank’s 2.0% target by the end of March 2019, citing sluggish consumption and low wage hikes.

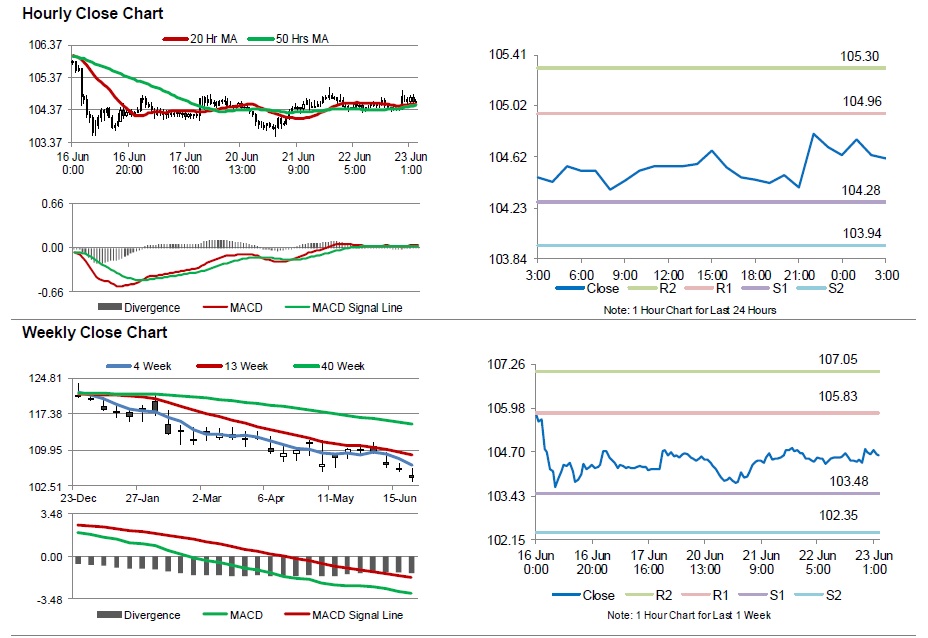

The pair is expected to find support at 104.28, and a fall through could take it to the next support level of 103.94. The pair is expected to find its first resistance at 104.96, and a rise through could take it to the next resistance level of 105.30.

Going ahead, investors will look forward to Japan’s final leading economic and coincident indices data for April, scheduled to release in a few hours.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.