For the 24 hours to 23:00 GMT, the USD rose 1.22% against the JPY and closed at 112.46.

In the Asian session, at GMT0400, the pair is trading at 112.79, with the USD trading 0.29% higher against the JPY from yesterday’s close.

Overnight data showed that, Japan’s preliminary Nikkei manufacturing PMI indicated that manufacturing sector continued to improve for a fourth straight month, albeit at a slower pace of 51.1 in November, compared to a level of 51.4 in the previous month. Additionally, the nation’s final coincident index rose to a level of 112.7 in September, compared to a reading of 111.9 in the prior month and following a rise to a level of 112.1 in the preliminary print. On the other hand, the final leading economic index eased to a level of 100.3 in September, compared to a reading of 100.9 in the prior month, while it had indicated a drop to a level of 100.5 in the preliminary estimate.

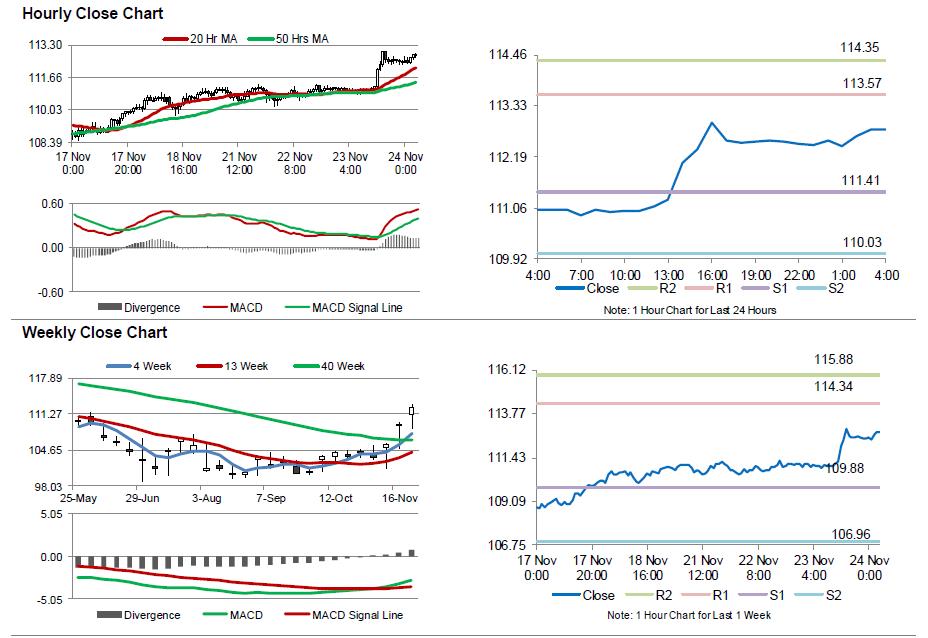

The pair is expected to find support at 111.41, and a fall through could take it to the next support level of 110.03. The pair is expected to find its first resistance at 113.57, and a rise through could take it to the next resistance level of 114.35.

Investors would concentrate on Japan’s National consumer price index for October, due to release overnight.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.