For the 24 hours to 23:00 GMT, the USD declined 0.45% against the JPY and closed at 105.84.

Macroeconomic data revealed that Japan’s final Nikkei manufacturing PMI dropped to a level of 53.1 in March, more than the preliminary print indicating a fall to a level of 53.2. In the prior month, the PMI had registered a reading of 54.1.

On Friday, data revealed that Japan’s jobless rate climbed less-than-anticipated to 2.5% in February, from a rate of 2.4% in the previous month, while investors had envisaged for an advance to 2.6%. On the contrary, the nation’s preliminary industrial production rebounded 4.1% on a monthly basis in February, undershooting market consensus for a gain of 5.0%. Industrial production had registered a drop of 6.8% in the prior month.

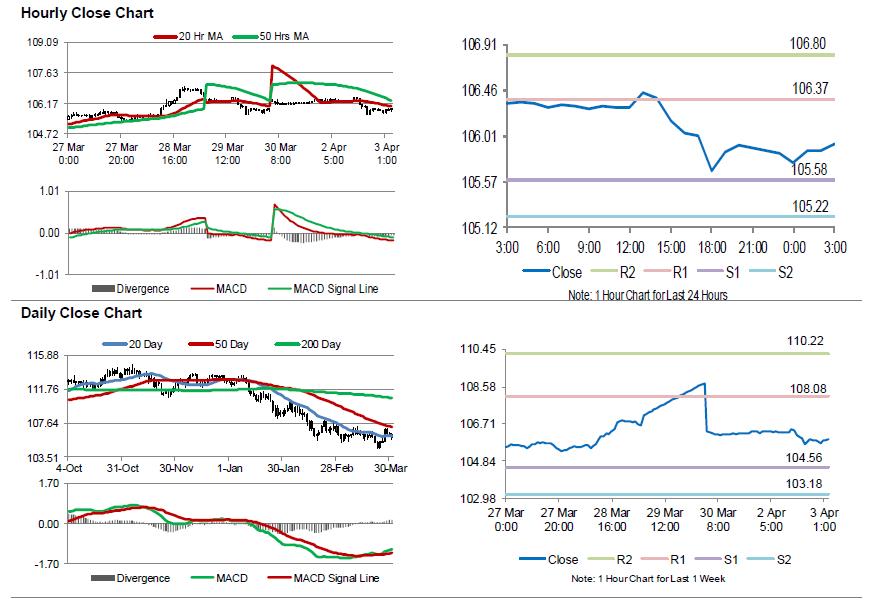

In the Asian session, at GMT0300, the pair is trading at 105.93, with the USD trading 0.09% higher against the JPY from yesterday’s close.

The pair is expected to find support at 105.58, and a fall through could take it to the next support level of 105.22. The pair is expected to find its first resistance at 106.37, and a rise through could take it to the next resistance level of 106.80.

Moving ahead, Japan’s Nikkei services PMI for March, due to release overnight, will attract significant amount of market attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.