For the 24 hours to 23:00 GMT, the USD rose 0.64% against the JPY and closed at 109.71.

In the Asian session, at GMT0300, the pair is trading at 109.52, with the USD trading 0.17% lower against the JPY from yesterday’s close.

Overnight data indicated that Japan’s flash Nikkei manufacturing PMI rose to a level of 52.8 in August, expanding at its fastest pace in three months, as domestic as well as export orders rebounded. The PMI had recorded a level of 52.1 in the prior month.

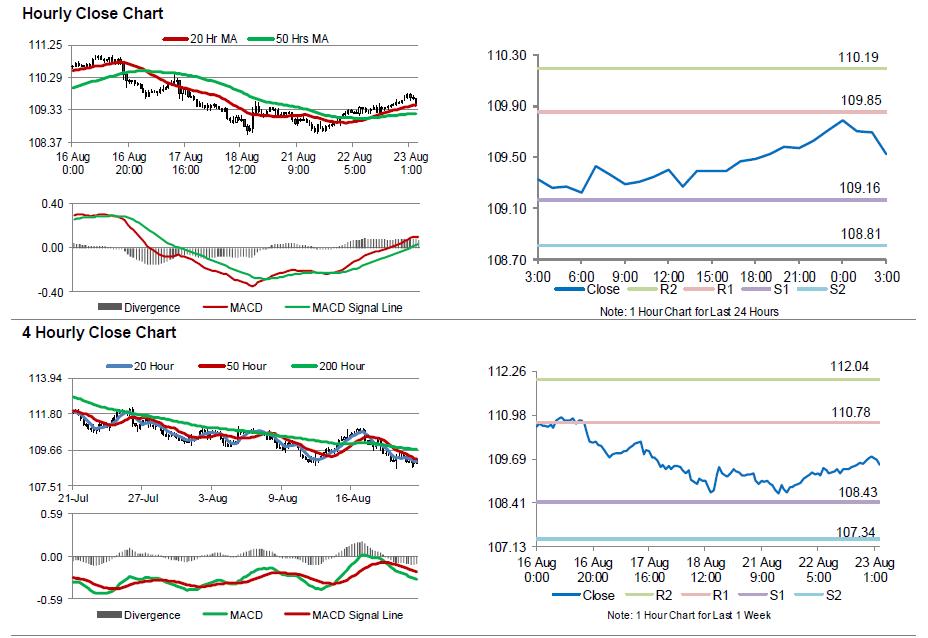

The pair is expected to find support at 109.16, and a fall through could take it to the next support level of 108.81. The pair is expected to find its first resistance at 109.85, and a rise through could take it to the next resistance level of 110.19.

Going ahead, Japan’s final machine tool orders for July, set to release in a while, will be eyed by investors.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.