For the 24 hours to 23:00 GMT, the USD strengthened 0.23% against the JPY and closed at 101.77, paring its initial losses, triggered by dovish comments by the Fed Chief, Janet Yellen.

Yesterday, a survey report from the BoJ, showed that Japanese firms forecasted inflation of 1.5% for 2014, below the central bank’s inflation target of 2.0%. Furthermore, the survey also revealed that the firms expect Japan’s inflation rate to rise to 1.6% in three years and 1.7% in five years.

In the Asian session, at GMT0300, the pair is trading at 101.88, with the USD trading 0.11% higher from yesterday’s close.

Earlier today, Markit Economics reported that its PMI measuring activities in Japan’s service sector fell to a reading of 49.0 in June, staying in the contraction territory for the third consecutive month.

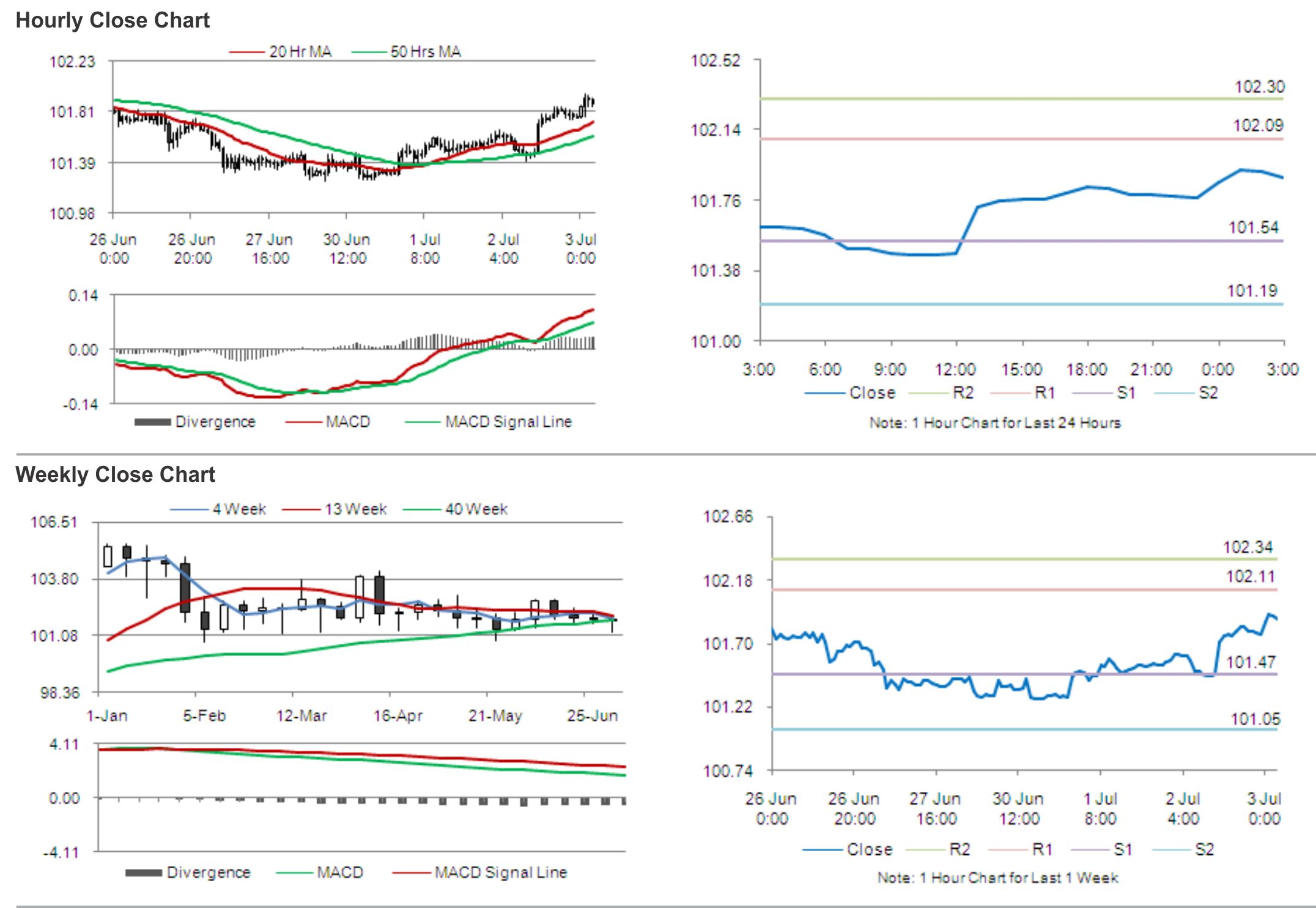

The pair is expected to find support at 101.54, and a fall through could take it to the next support level of 101.19. The pair is expected to find its first resistance at 102.09, and a rise through could take it to the next resistance level of 102.30.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.