For the 24 hours to 23:00 GMT, the USD weakened 0.20% against the JPY and closed at 102.12, as traders reacted negatively to the Fed Chief, Janet Yellen’s testimony before the Senate and after the rising tensions in Ukraine boosted haven demand for yen.

Yesterday, in Japan, the Bank of Japan (BoJ) policymaker, Takehiro Sato hinted the possibility for the central bank to opt for a flexible approach in deciding the time for exiting its ultra-easy stimulus measure.

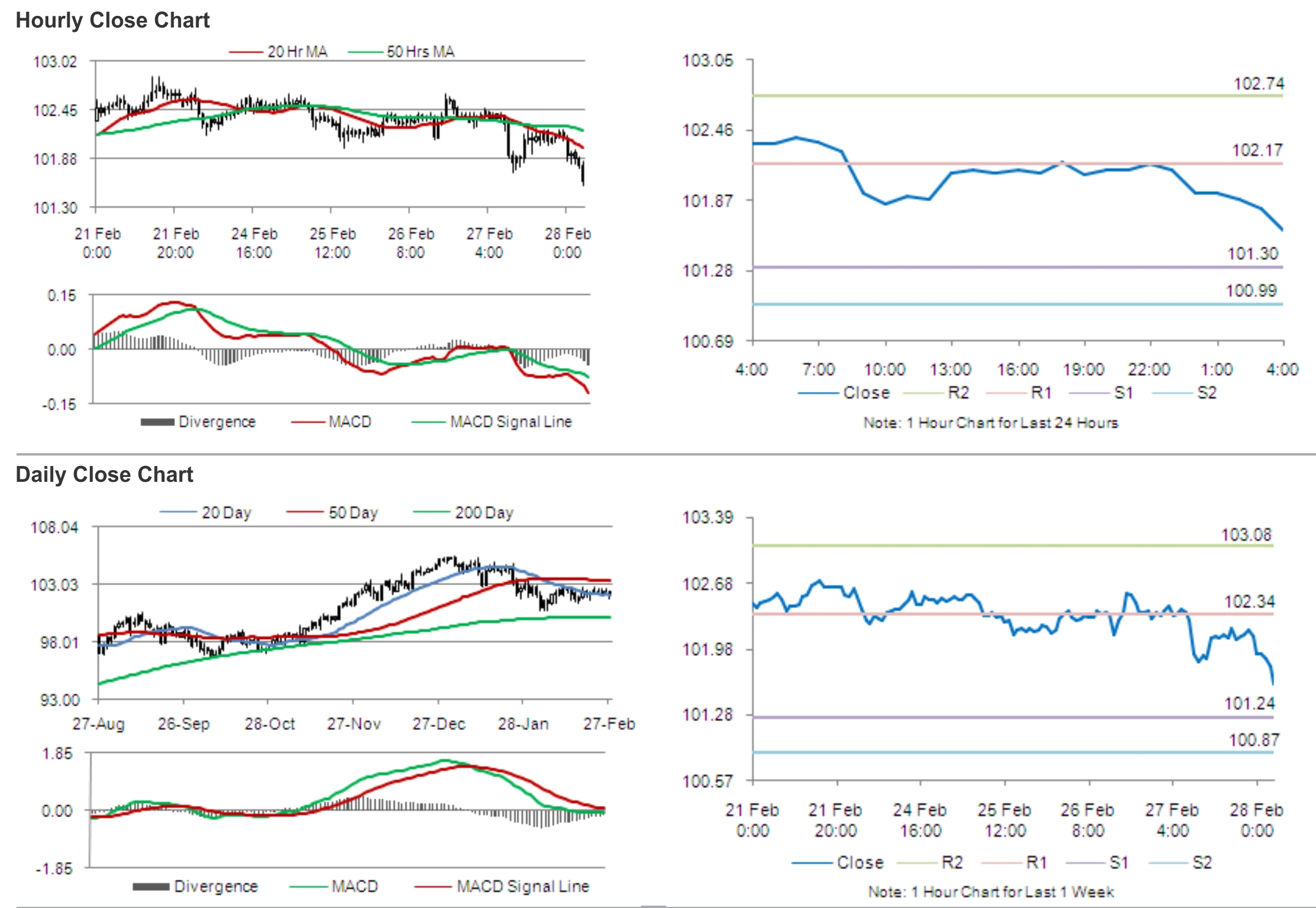

In the Asian session, at GMT0400, the pair is trading at 101.61, with the USD trading 0.50% lower from yesterday’s close.

Early morning, in Japan, data showed that the national consumer price index rose 1.4% (YoY) in January, following a 1.6% rise recorded in December while unemployment in the nation stood pat at previous month’s level of 3.7% in January, in-line with market expectations. Another report revealed that the nation’s industrial production rose more than analysts’ estimates by 4.0% (MoM) in January, compared to a 0.9% rise registered in the preceding month. Likewise, the overall household spending and retail sales also registered an upbeat rise of 1.1% (YoY) and 4.4% (YoY) in January. Meanwhile, the housing starts climbed 12.3% in January, as compared to an 18.0% rise recorded in the previous month.

The pair is expected to find support at 101.30, and a fall through could take it to the next support level of 100.99. The pair is expected to find its first resistance at 102.17, and a rise through could take it to the next resistance level of 102.74.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.