For the 24 hours to 23:00 GMT, the USD declined 1.90% against the JPY and closed at 108.06.

In the Asian session, at GMT0400, the pair is trading at 109.33, with the USD trading 1.18% higher against the JPY from yesterday’s close.

Overnight data showed that Japan’s national consumer price index rose 0.4% on a yearly basis in February, undershooting market consensus for a rise of 0.8% and compared to an advance of 0.7% in the previous month.

The Bank of Japan (BoJ), in its monetary policy meeting minutes, revealed that most members agreed that it was appropriate to continue with the current monetary easing policy, in wake of the coronavirus outbreak. However, one official suggested that negative rate could affect investor sentiment by making households, firms more pessimistic about economic outlook. Meanwhile, a policymaker cautioned that the central bank must brace for the risk of another recession by strengthening cooperation with the government’s fiscal policy.

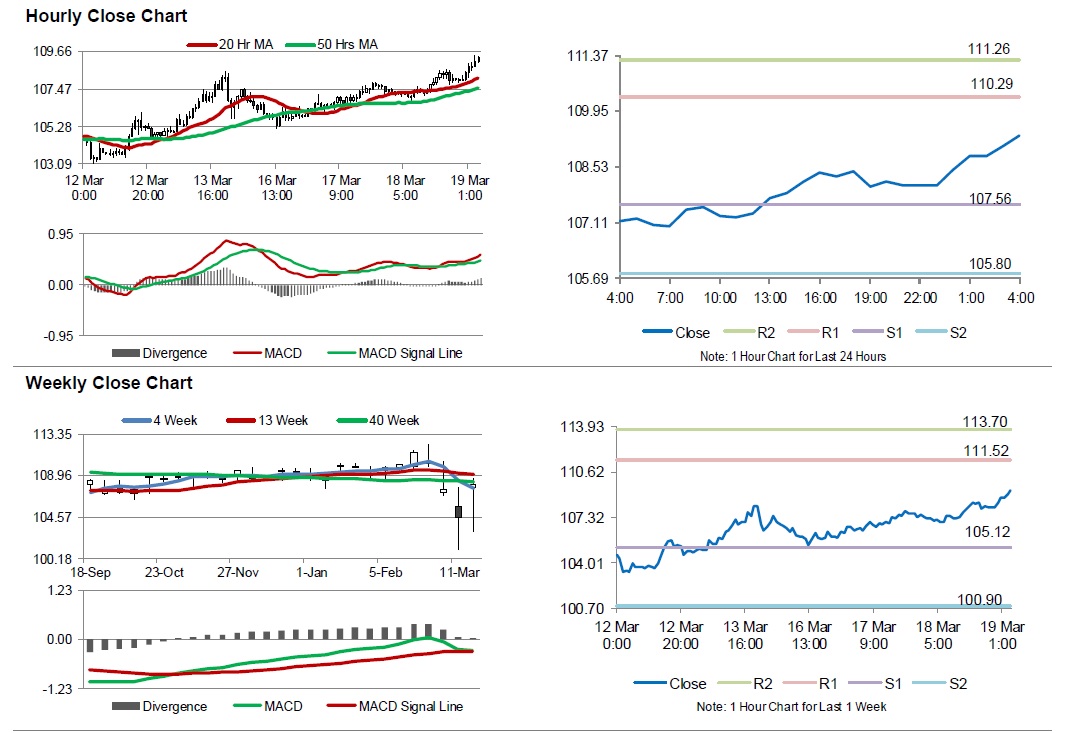

The pair is expected to find support at 107.56, and a fall through could take it to the next support level of 105.80. The pair is expected to find its first resistance at 110.29, and a rise through could take it to the next resistance level of 111.26.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.