For the 24 hours to 23:00 GMT, the USD rose 0.72% against the JPY and closed at 111.35.

In the economic news, Japan’s final leading economic index declined to a level of 104.7 in July, after registering a reading of 106.9 in the previous month. The preliminary figures had recorded a fall to 105.2. Meanwhile, the nation’s final coincident index eased to a level of 116.4 in July, compared to a level of 116.8 in the prior month. The preliminary figures had recorded a drop to 116.3.

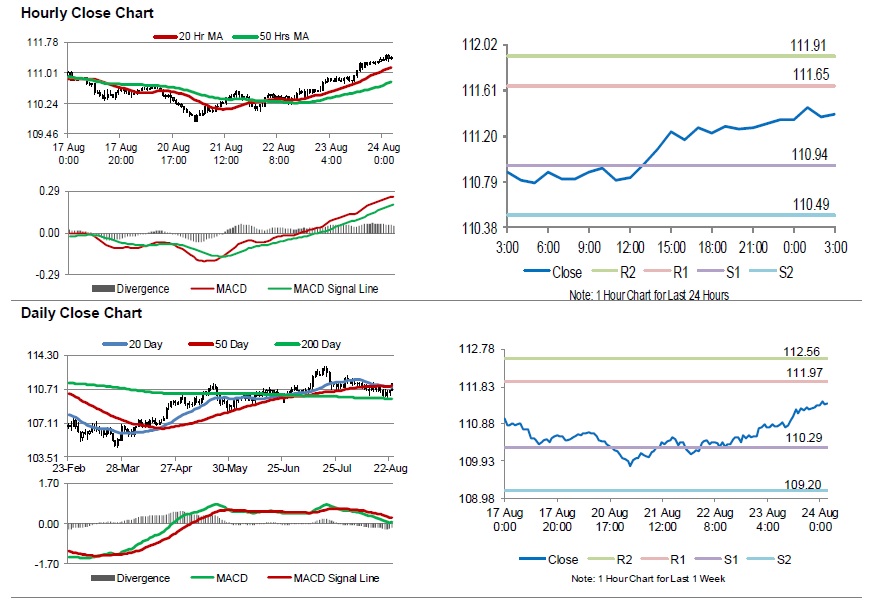

In the Asian session, at GMT0300, the pair is trading at 111.39, with the USD trading slightly higher against the JPY from yesterday’s close.

Overnight data indicated that, Japan’s national consumer price index (CPI) climbed 0.9% on a yearly basis in July, falling short of market expectations for a rise of 1.0%. In the previous month, the CPI had recorded a gain of 0.7%.

The pair is expected to find support at 110.94, and a fall through could take it to the next support level of 110.49. The pair is expected to find its first resistance at 111.65, and a rise through could take it to the next resistance level of 111.91.

Trading trend in the Japanese Yen is expected to be determined by housing starts, retail trade, large retailers’ sales, consumer confidence index, all set to release next week.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.