For the 24 hours to 23:00 GMT, the USD declined 0.21% against the JPY and closed at 110.98 on Friday.

In the Asian session, at GMT0300, the pair is trading at 111.09, with the USD trading 0.10% higher against the JPY from Friday’s close.

Overnight data revealed that, Japan’s retail trade jumped 1.8% on a yearly basis in June, more than market expectations for an advance of 1.7%. In the previous month, retail trade had climbed 0.6%. Moreover, large retailer’s sales rebounded 1.5% on a monthly basis in June, following a drop of 2.0% in the previous month. Market participants had anticipated large retailer’s sales to record a rise of 1.6%.

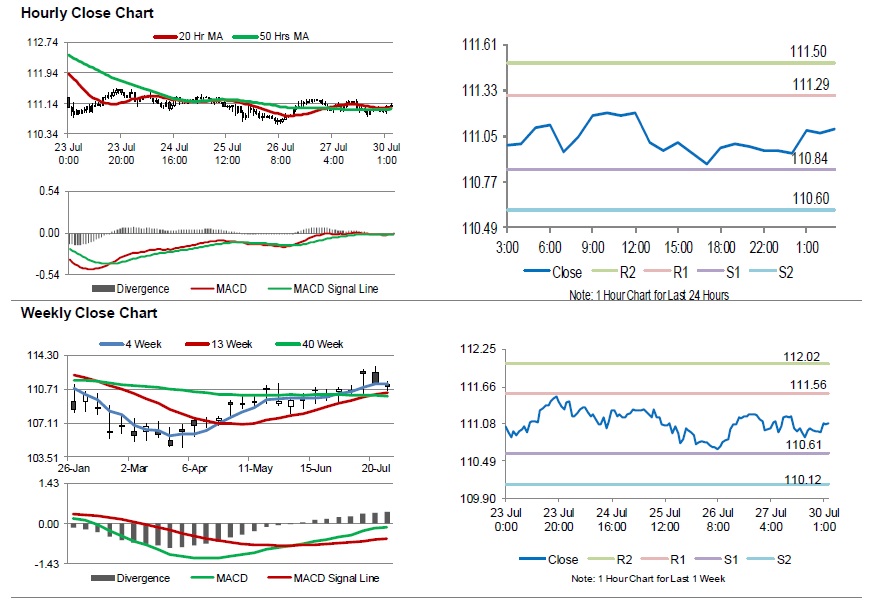

The pair is expected to find support at 110.84, and a fall through could take it to the next support level of 110.60. The pair is expected to find its first resistance at 111.29, and a rise through could take it to the next resistance level of 111.50.

Going forward, investors will keep an eye on Japan’s crucial interest rate decision along with jobless rate and industrial production data, both for June, set to release overnight.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.