For the 24 hours to 23:00 GMT, the USD strengthened 0.60% against the JPY and closed at 102.60.

In the Asian session, at GMT0300, the pair is trading at 102.44, with the USD trading 0.16% lower against the JPY from yesterday’s close.

Overnight data showed that, Japan’s retail trade fell more-than-expected by 1.9% YoY in May, the third consecutive month of contraction, reinforcing the Japan Prime Minister, Shinzo Abe’s, decision to delay a sales tax increase far into the future. In the prior month, retail trade had fallen by a revised 0.9%. However, on a monthly basis, retail trade remained flat in May, in line with market expectations and slightly better than the revised 0.1% drop reported in the previous month.

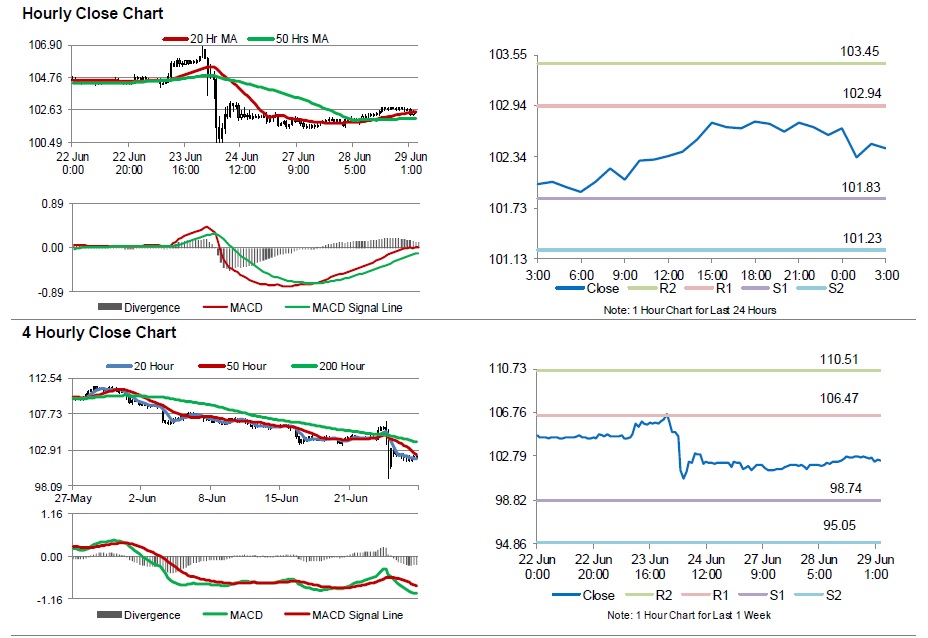

The pair is expected to find support at 101.83, and a fall through could take it to the next support level of 101.23. The pair is expected to find its first resistance at 102.94, and a rise through could take it to the next resistance level of 103.45.

Looking ahead, investors await the release of Japan’s flash industrial production data for May, due tonight.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.