For the 24 hours to 23:00 GMT, the USD strengthened 0.26% against the JPY and closed at 121.06.

In the Asian session, at GMT0400, the pair is trading at 121.2, with the USD trading 0.12% higher from yesterday’s close.

Overnight data showed that Japan’s monetary base advanced 32.5% YoY in October, following a 35.1% rise in the previous month.

Earlier today, data indicated that the nation’s Markit services PMI index rose to a level of 52.2 in October, from a reading of 51.4 in September.

Further, Japan’s consumer confidence index rose more-than-expected to a level of 41.5 in October, from a reading of 40.6 in the prior month. Investors had expected it to rise to a level of 40.8.

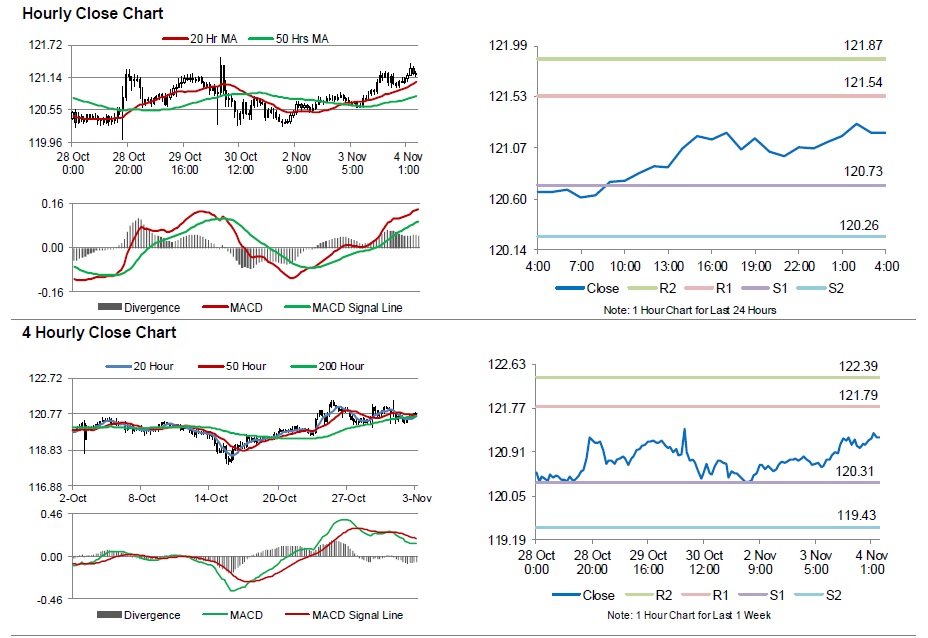

The pair is expected to find support at 120.73, and a fall through could take it to the next support level of 120.26. The pair is expected to find its first resistance at 121.54, and a rise through could take it to the next resistance level of 121.87.

Going ahead, investors will keep a close watch on BoJ’s monetary policy meeting minutes, scheduled to be released overnight.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.