For the 24 hours to 23:00 GMT, the USD rose 0.77% against the JPY and closed at 104.26.

On the data front, Japan’s preliminary machine tool orders eased by 6.3% on a YoY basis in September, following a drop of 8.4% in the prior month.

In the Asian session, at GMT0300, the pair is trading at 103.72, with the USD trading 0.52% lower against the JPY from yesterday’s close.

Earlier today, data showed that, Japan’s tertiary industry index unexpectedly remained flat on a monthly basis in August, confounding expectations for a drop of 0.2% and after recording a gain of 0.3% in the preceding month.

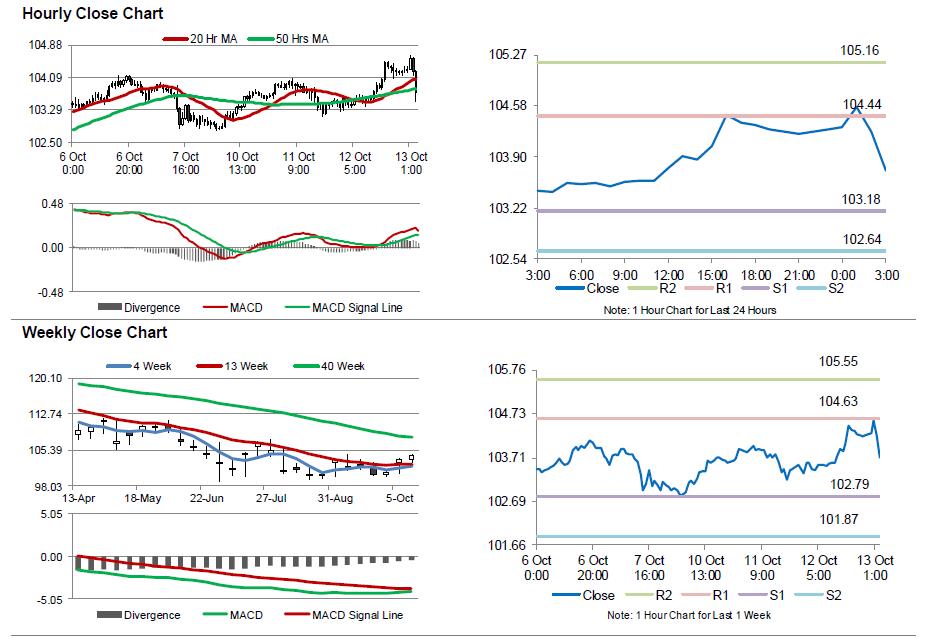

The pair is expected to find support at 103.18, and a fall through could take it to the next support level of 102.64. The pair is expected to find its first resistance at 104.44, and a rise through could take it to the next resistance level of 105.16.

With no economic releases in Japan today, Yen investors would look to global events for direction.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.