For the 24 hours to 23:00 GMT, the USD rose 0.21% against the JPY and closed at 106.12.

In the Asian session, at GMT0300, the pair is trading at 106.47, with the USD trading 0.33% higher against the JPY from Friday’s close.

Overnight data indicated that, Japan’s merchandise trade balance posted a more-than-expected surplus of ¥692.8 billion in June. Markets expected the nation to post a trade surplus of ¥474.4 billion, after recording a revised trade deficit of ¥40.6 billion in the previous month. Meanwhile, the nation’s exports dropped less-than-expected by 7.4% on an annual basis in June, falling for ninth consecutive month, while markets expected it to fall by 11.3%. Also, the imports recorded its eighteenth straight fall, after declining by 18.8% YoY in June, lower than market expectations for a drop of 20.0% and after recording a drop of 13.8% in the prior month, thus indicating that the world’s third largest economy was hampered by weak demand both domestically and internationally.

Early morning data indicated that, Japan’s final coincident index eased to 109.9 in May. In the previous month, the coincident index had recorded a level of 112.00. Also, the final leading economic index dropped to 99.7 in May, compared to a reading of 100.0 in the previous month.

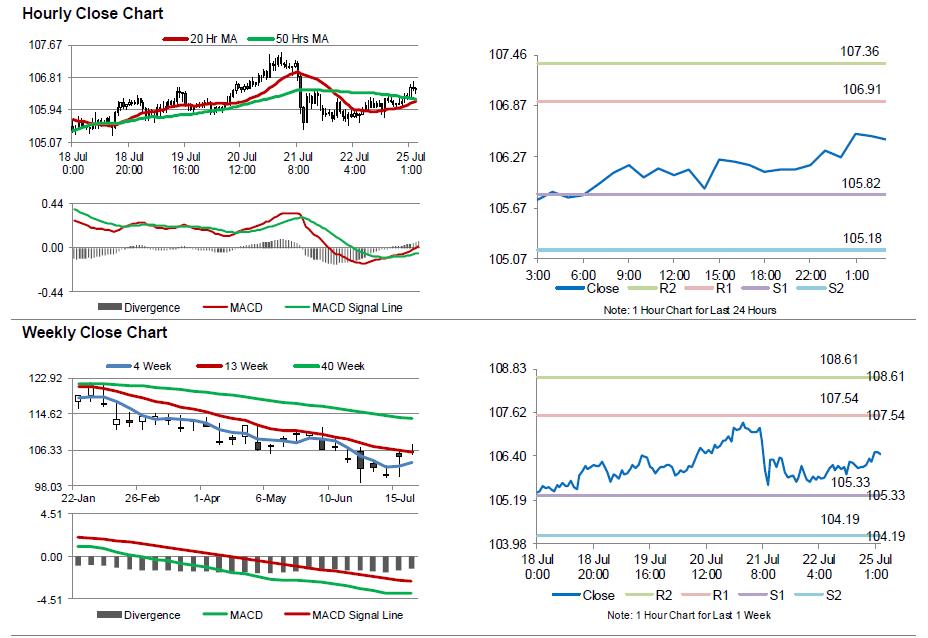

The pair is expected to find support at 105.82, and a fall through could take it to the next support level of 105.18. The pair is expected to find its first resistance at 106.91, and a rise through could take it to the next resistance level of 107.36.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.