For the 24 hours to 23:00 GMT, the USD declined 0.11% against the JPY and closed at 109.17 on Friday.

In economic news, Japan’s preliminary coincident index advanced to a level of 101.0 in September, higher than market consensus for a rise to a level of 99.5. In the prior month, the index had registered a reading of 99.0. Moreover, the nation’s preliminary leading economic index unexpectedly rose to a level of 92.2 in September, defying market expectations for a fall to a level of 91.7. In the preceding month, the index had recorded a reading of 91.9.

In the Asian session, at GMT0400, the pair is trading at 109.04, with the USD trading 0.12% lower against the JPY from Friday’s close.

Overnight data revealed that Japan’s machinery orders climbed 5.1% on an annual basis in September, less than market expectations for a rise of 7.9%. In the prior month, machinery orders had recorded a decline of 14.5%. Meanwhile, the nation’s trade surplus (BOP basis) unexpectedly narrowed to ¥1.1 billion in September, following a surplus of ¥50.9 billion in the prior month

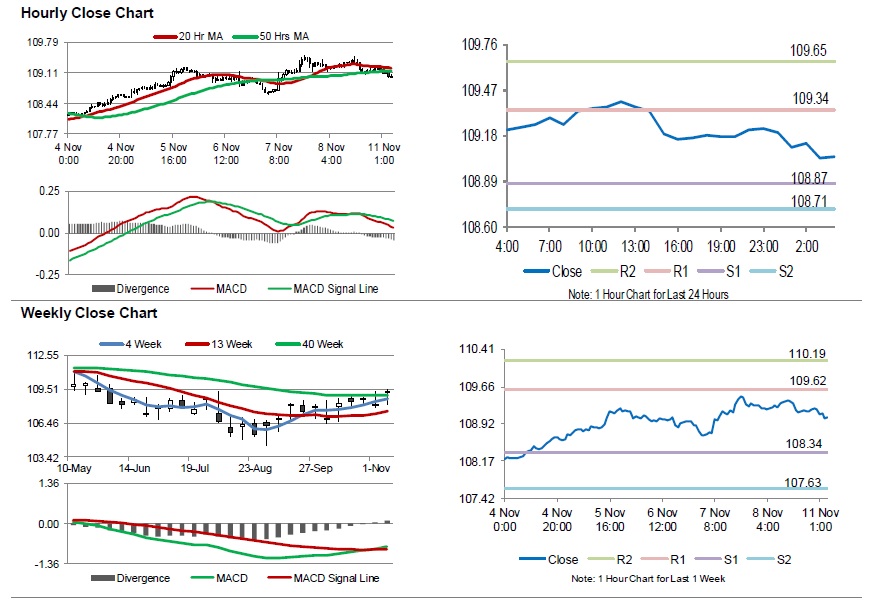

The pair is expected to find support at 108.87, and a fall through could take it to the next support level of 108.71. The pair is expected to find its first resistance at 109.34, and a rise through could take it to the next resistance level of 109.65.

Moving ahead, investors would await Japan’s machine tool orders for October, slated to release overnight.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.