For the 24 hours to 23:00 GMT, the USD declined 0.25% against the JPY and closed at 104.72.

In the Asian session, at GMT0300, the pair is trading at 104.29, with the USD trading 0.41% lower against the JPY from yesterday’s close.

Overnight data showed that Japan’s unemployment rate unexpectedly dropped to 2.8% in June, defying market forecast for a rise to 3.1% and compared to a rate to 2.9% in the prior month. Moreover, industrial production rose 2.7% on a monthly basis in June, more than market forecast for a rise of 1.2% and compared to a fall of 8.9% in the previous month.

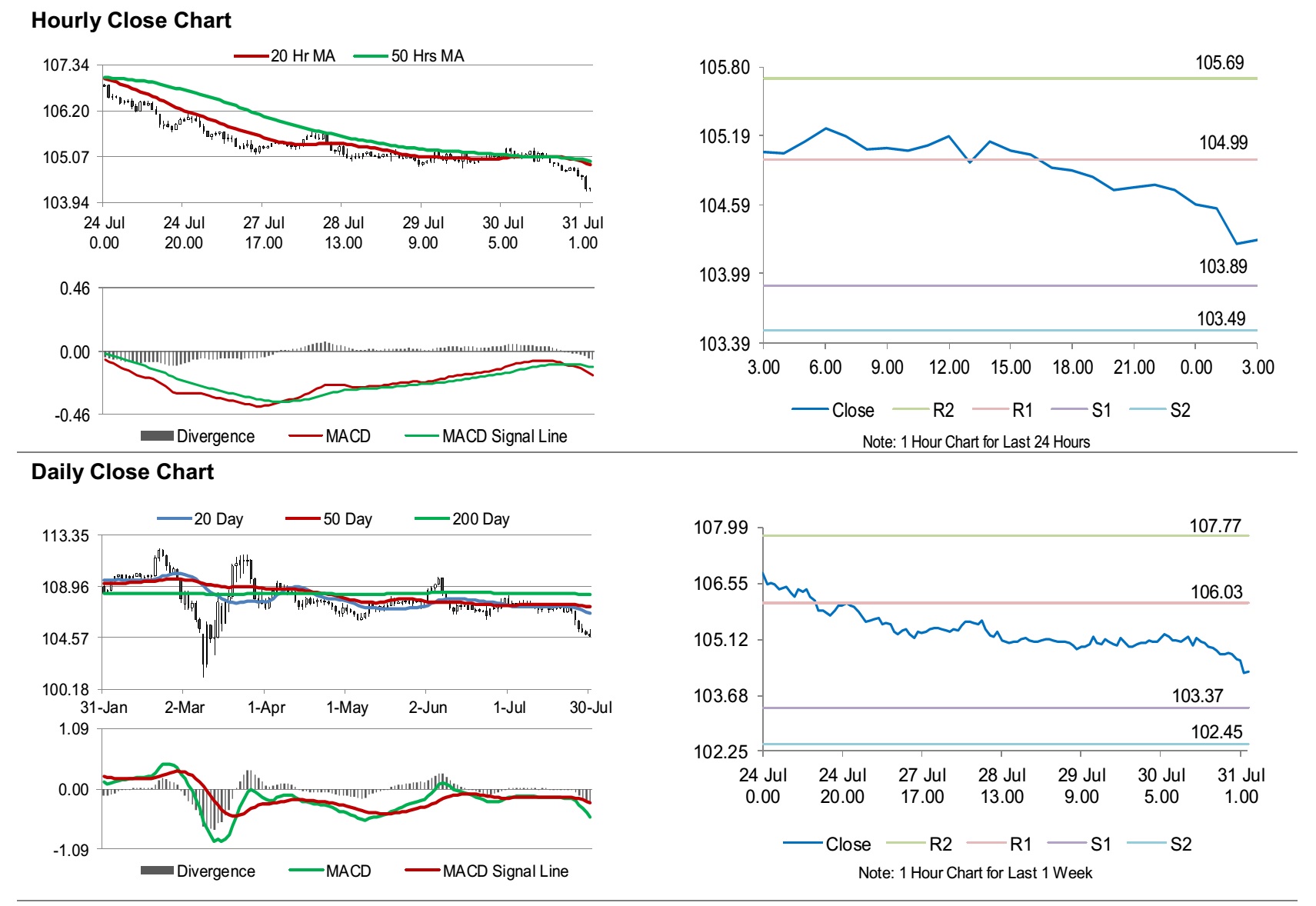

The pair is expected to find support at 103.89, and a fall through could take it to the next support level of 103.49. The pair is expected to find its first resistance at 104.99, and a rise through could take it to the next resistance level of 105.69.

Moving forward, traders would keep a watch on Japan’s construction orders and annualised housing starts, both for June, along with the consumer confidence index for July, slated to release in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.