For the 24 hours to 23:00 GMT, the USD rose 0.63% against the JPY and closed at 111.79.

In the Asian session, at GMT0300, the pair is trading at 112.06, with the USD trading 0.24% higher against the JPY from yesterday’s close.

Data released overnight showed that Japan’s national consumer price index (CPI) advanced above expectations by 0.3% on an annual basis in February, while investors had envisaged for a rise of 0.2%. In the previous month, the CPI had advanced 0.4%. Additionally, the nation’s jobless rate unexpectedly eased to 2.8% in February, marking its lowest level since June 1994 and boosting optimism over the health of the nation’s labour market. Markets had anticipated the jobless rate to remain steady at 3.0%.

Moreover, the nation’s flash industrial production rebounded 2.0% on a monthly basis in February, rising at the fastest pace in eight months and surpassing market expectations for a rise of 1.2%. In the previous month, industrial production had fallen 0.4%.

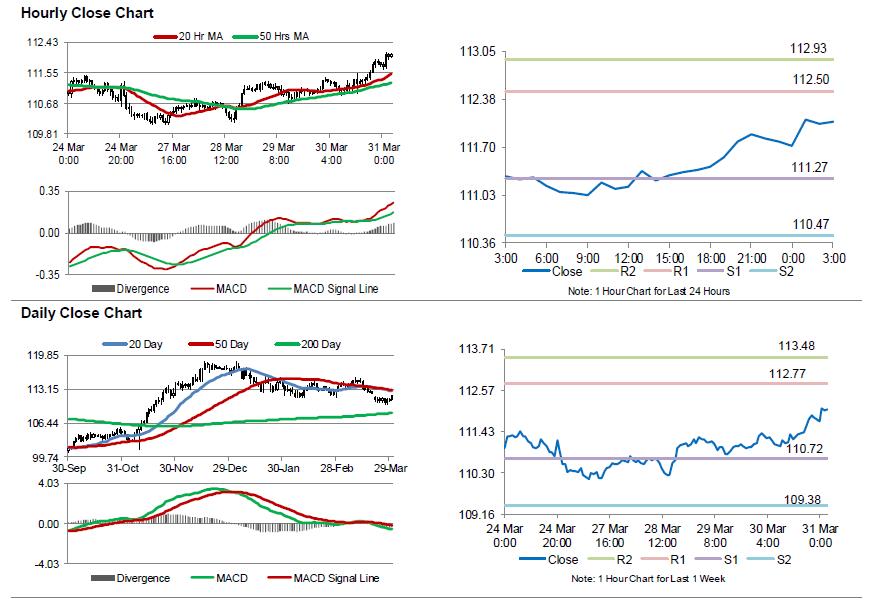

The pair is expected to find support at 111.27, and a fall through could take it to the next support level of 110.47. The pair is expected to find its first resistance at 112.5, and a rise through could take it to the next resistance level of 112.93.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.