For the 24 hours to 23:00 GMT, the USD weakened 0.17% against the JPY and closed at 123.08.

Yesterday, the Organisation for Economic Co-operation and Development (OECD), cut Japan’s growth forecast to 1.0% in 2016, from its earlier projection of 1.2%. It further predicted that the country’s growth in 2017 is likely to decelerate to 0.5%, owing to weak external demand and sluggish private consumption.

In the Asian session, at GMT0400, the pair is trading at 123.12, with the USD trading marginally higher from yesterday’s close.

Overnight data showed that Japan’s trade balance (BOP basis) registered a surplus of ¥82.3 billion in September, slightly falling short of market expectations for a trade surplus of ¥85.3 billion, and following a trade deficit of ¥326.1 billion in the previous month.

Data released in the morning showed that Japan’s Eco Watchers survey for current situation rose more-than-expected to a level of 48.2 in October, from a reading of 47.5 in the previous month. However, the nation’s Eco Watchers survey for future outlook remained unchanged at a reading of 49.1 in the same month, and lower than market expectations of an advance to a level of 49.3.

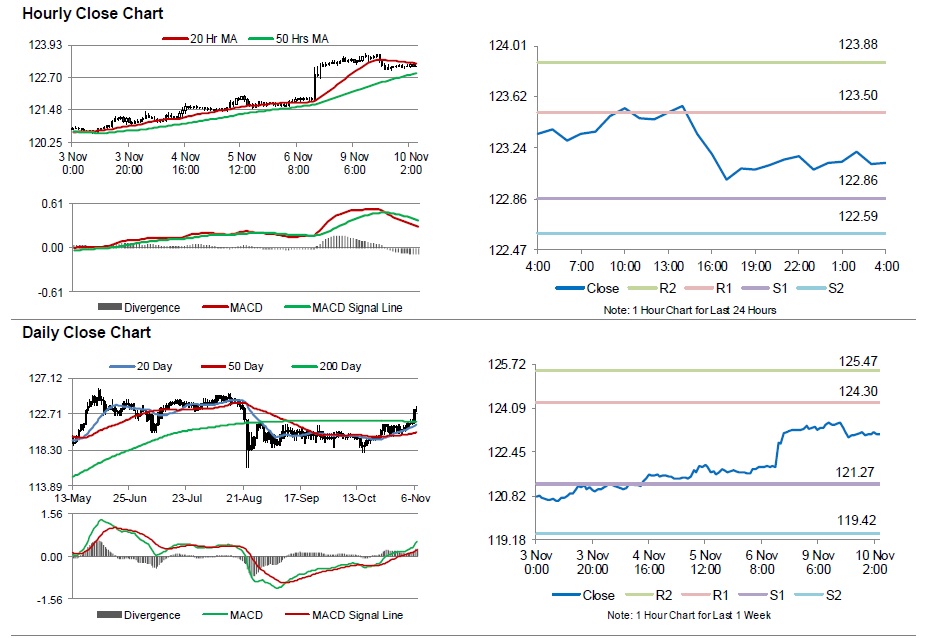

The pair is expected to find support at 122.86, and a fall through could take it to the next support level of 122.59. The pair is expected to find its first resistance at 123.50, and a rise through could take it to the next resistance level of 123.88.

Going ahead, investors will look forward to Japan’s machine tool orders data for October, scheduled to be released tomorrow.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.